As we saw in the previous chapter, financial statements include two fundamental documents for understanding a company's health: the balance sheet and the income statement. In this course on corporate management and finance, we will focus on the income statement, which is the most understandable document for a beginner, and we will then look at the balance sheet.

This content is part of the course “Business Management for Entrepreneurs: A Complete Course to Better Manage Your Business” find it on Tulipemedia.com 💰📈

Simple Definition of Income Statement

Unlike the Balance Sheet, which is a document that presents, in a way, the assets of a company, with all the history, the income statement lists the income and expenses of the current accounting year (one-year period), in order to estimate a company's performance and profitability.

The income statement allows you to calculate the company's net profit, which can be positive or negative. It is important to understand that this table only takes into account the financial year in question, and thus allows the entrepreneur or decision-maker to know whether the company's current economic model is profitable or not, and to calculate certain ratios.

Structure of the income statement

The income statement table has two main categories: the company's expenses on one side, and revenue on the other. Revenue is what the company receives and produces as wealth. Expenses represent everything the company has to pay.

| PRODUCTS | CHARGES |

|---|---|

| Net turnover | Purchases of goods |

| Stored/immobilized production | Purchases of raw materials |

| Operating grants | External charges (rent, subcontracting, etc.) |

| Other operating income | Taxes, duties and similar payments |

| Reversals of depreciation and provisions | Salaries and wages |

| Financial products | Social charges |

| Exceptional products | Depreciation and provisions |

| Financial charges | |

| Exceptional charges | |

| Employee participation | |

| Profit tax | |

| → Net result for the financial year | |

It allows us to identify 4 types of results:

Do you have a business and want to regain control of your margins and your business model? Discover my solution Ultimate Business Dashboard which transforms your raw accounting data into performance indicators and a monthly dashboard.

- Operating result:

This is the difference between operating income and operating expenses. It represents what the company "earns" from its core business, its operations.

Example: for a restaurant, it is simply the sales from which we subtract the purchases of goods, and all the expenses related to the operation (for example rent, salaries, etc.).

- The financial result:

These are financial products (e.g. investments) less financial charges (e.g. interest from bank loans).

This result is often negative for many companies, but the amount is often marginal, so there is no need to worry, since these are not items related to the company's core business.

- The exceptional result:

Here, we are talking about exceptional products (example: a donation, a sale of equipment, or any other enrichment which is exceptional) less exceptional expenses (example: a fine, a transaction following an industrial tribunal, etc.).

Here again, with some exceptions, the often negative result is not alarming, because it is supposed to remain marginal compared to movements linked to the company's activity.

- The net result

In the net result, we add:

Operating result + Financial result + Exceptional result – Employee profit-sharing – Corporate tax.

In France, participation is a employee savings scheme ensuring the redistribution, for the benefit of employees, of a portion of the company's profits. It is therefore removed from the net result, in the same way as corporate tax, in order to have the net result, therefore the final margin of the company.

It's this net income that will tell us whether the company is profitable or not. And this net income will be added to the Equity, in the Liabilities section of the company's Balance Sheet, but don't panic, I'll explain all that in the next chapter.

Link with the General Accounting Plan

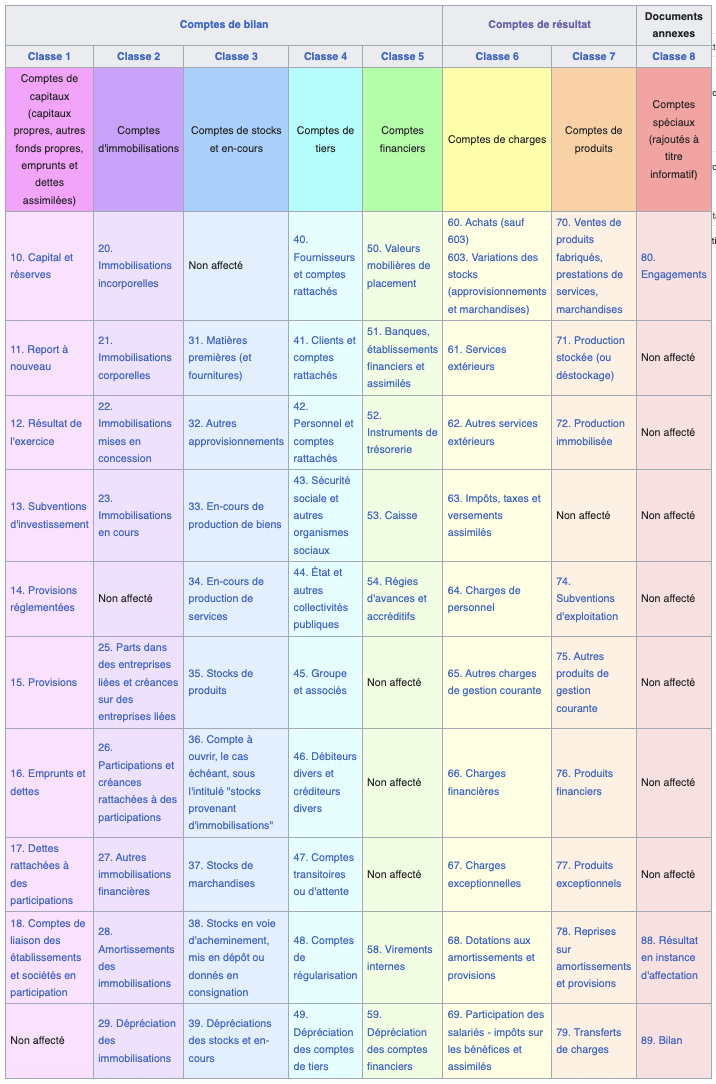

In the General Accounting Plan (PCG), which is a French document that classifies all of a company's financial accounts (purchases of goods, personnel expenses, etc.), the accounts are arranged by class. For example, personnel expenses are in account 64.

I'll come back to the PCG in detail later, but it basically allows you to find the account number concerned by an accounting transaction. In the PCG, all accounts linked to the income statement are found in classes 6 (expense accounts) and 7 (income accounts). The international equivalent of the PCG is IFRS.

Expenses in the income statement

In the income statement table, you will find 3 types of expenses.

Operating expenses

These are all the expenses linked to the operation of the company, therefore to its main activity, for example:

- Purchases of raw materials

- Purchases of goods

- Wages

- Insurance premiums

- Rents

- Taxes and duties

- Electricity, gas, water…

Operating expenses include all accounts from 60 to 65, as well as account 68.

Accounts 60 to 65 include purchases, stock variations, expenses related to external services, taxes, etc. In short, everything we have seen above.

Here is an image that gives you an idea of the accounts contained in the PCG, and the income statement here contains columns 6 and 7, and the operating expenses accounts 60 to 65, as well as account 68:

About account 68: Depreciation and provisions

Regarding account 68, I could write a chapter dedicated to this account, but it basically concerns depreciation and provisions. To be brief, this particularly concerns the case where the company acquires, for example, a large machine (this is called a tangible fixed asset), intended to be used over several years.

And to reflect a true picture, the entire amount spent on this machine is not recorded in the income statement as an expense (which could "weigh down" the net result), but the amount is "split" into several annual amounts called depreciation. This allows the company's expenses not to be increased excessively in a given year, while the machine will be used for several years.

In other words, this expense is smoothed out to reflect reality. Furthermore, from a strategic perspective, this helps improve the company's net profit over the past year, since the expense is spread over several years.

Conversely, if the company wishes to reduce its profit (for tax reasons, for example), it may be in its interest not to amortize a purchase.

Financial charges

The second expense item in the income statement is financial expenses. As their name suggests, these are expenses related to financial issues, such as loan interest. These expenses are subtracted from financial income to produce the financial result, which is often a minor issue in the income statements of small and medium-sized businesses.

Exceptional charges

Exceptional expenses are related to exceptional issues, such as a fine. These are expenses that are not related to the company's core business. It is important to have an overview of these, just like exceptional income, because a year's income statement may be "abnormal" compared to usual due to exceptional expenses or income that would not reflect the company's long-term performance.

Now that we have seen the three types of expenses contained in the income statement, let's move on to Income.

Products in the income statement

Just as there are 3 types of expenses in the income statement, there are 3 types of income, symmetrically to the expenses: operating income, financial income and exceptional income.

Operating income

Operating income is all the wealth generated by the company as part of its core business. It includes all accounts 70 to 75 in the PCG.

For example :

- Sale of goods (purchase/resale) – Account 707

- Services – Account 706

- Sale of finished products (products processed or manufactured by the company) – Account 701

- Stored production – Accounts 71

- Fixed assets – Accounts 72: these are products that are “kept” by the company for its needs, its employees, etc. on a long-term basis.

- Operating subsidies – Account 74: for example, an amount received by the company from the State to help it settle a short-term expense (bill, etc.). This differs from an investment subsidy, which is aid received to finance a durable good or service, over more than one year.

- Other current management income – Account 75: This relates to income received for products or services that are not part of the sale of goods, products or services, nor to other income accounts. For example: royalties received for a patent, income received for the rental of buildings not used for the company's main activity, miscellaneous current management income, etc.

Financial products

Like financial expenses, financial income is income earned through investments, for example. These are therefore financial investments held by the company, although financial income also includes discounts obtained.

Exceptional products

Exceptional products include everything the company has been able to touch in the context of issues that are exceptional and do not concern the company's main activity.

Now that we have a good understanding of each load and product heading, the 4 types of results mentioned at the beginning of this chapter take on their full meaning:

- The operating result (which we hope is positive) measures the margin linked to the company's operations; it is the most important indicator.

- The financial result and the exceptional result estimate the financial and exceptional margins (which can be negative without this being a problem).

- And finally, the net result is equal to the operating result + financial result (or – financial result if this is negative) + exceptional result (or – exceptional result if this is negative).

The income statement is the main document that you need to know how to read when you are a business leader, a decision-maker, a manager or a buyer, because it is this document that allows us to know if the company's economic model is viable, year after year. Most laypeople only inquire about turnover and rent, vaguely about personnel costs, without analyzing the income statement in detail, which is a serious mistake.

Theoretical table of the income statement according to the list presentation of the French PCG (commonly used for SMEs)

Here is a detailed view of the Income Statement based on the French General Accounting Plan, to give an idea of each expense account and each income account.

INCOME STATEMENT (financial year from __/__/____ to __/__/____)

I – OPERATING PRODUCTS: income generated by the company’s main activity

- Net sales: total sales after deductions such as discounts or returns

- Production sold (goods and services): value of manufactured products and services sold to customers

- Stocked production: value of products manufactured but still in stock, not sold

- Fixed assets: value of products manufactured for internal use by the company, such as machinery

- Operating subsidies: financial aid received from the State for current activity (and not for long-term investment)

- Other income: miscellaneous income related to the activity, such as rent received

- Reversals of depreciation and provisions, transfers of charges: recovery of amounts previously set aside for wear and tear or risks

II – OPERATING EXPENSES: expenses related to the company’s main activity

- Purchases of goods: cost of products purchased for resale as is (purchase/resale)

- Change in merchandise inventory: This is the difference between the merchandise inventory at the beginning and end of the year. If there is more inventory at the end of the year than at the beginning, then the inventory change is negative because the inventory has increased. This is counterintuitive, but it's because you shouldn't double-count the expenses related to purchasing merchandise and the inventory not yet sold. This will be detailed in a dedicated article.

- Purchases of raw materials and other supplies: cost of materials used to manufacture products

- Change in raw material inventory: Same logic as for the change in merchandise inventory. Change = Beginning inventory – Ending inventory. If positive because the ending inventory would be lower than the beginning inventory, it means that more raw materials were sold than purchased, so operating expenses are increased to reflect the additional cost of materials consumed (from old inventory), so that the income statement shows the true production cost for the year.

- Other purchases and external expenses: expenses such as rental, advertising or external services

- Taxes, duties and similar payments: compulsory payments to the State, excluding income tax

- Wages and salaries: remuneration paid to employees

- Social security contributions: social security contributions paid for employees, such as social security

- Depreciation and provisions: amounts set aside for wear and tear of assets or future risks

- Other expenses: miscellaneous expenses related to the activity, not classified elsewhere

→ Operating result (I – II): profit or loss from the main activity, before finances and exceptions

III – FINANCIAL PRODUCTS: income related to finances, such as investments

- Equity income: income from shares held in other companies

- Other interest and similar income: interest received on loans or investments

- Reversals of provisions and transfers of charges: recovery of amounts set aside for financial risks

IV – FINANCIAL CHARGES: expenses related to finances, such as loans

- Interest and similar charges: interest paid on debts or loans

- Provisions: amounts set aside for future financial risks

→ Financial result (III – IV): gain or loss from financial transactions

→ Current result before tax (Operating result + Financial result): total gain or loss from normal activity, before taxes and exceptions

V – EXCEPTIONAL PRODUCTS: unusual income, not linked to current activity

- Income from management operations: exceptional gains on unusual current sales

- Capital gains: gains on the sale of major assets, such as a building

- Reversals of provisions and transfers of charges: recovery of amounts set aside for exceptional risks

VI – EXCEPTIONAL CHARGES: unusual expenses, not related to current activity

- Expenses on management operations: exceptional losses on current operations

- Capital transaction charges: losses on the sale or destruction of significant assets

- Provisions: amounts set aside for future exceptional risks

→ Exceptional result (V – VI): gain or loss from unusual events

VII – Employee profit sharing: share of profits paid to employees, if applicable

VIII – Profit tax: tax paid on the company’s profits

→ NET RESULT FOR THE YEAR (Profit or Loss): final gain or loss of the year, after all

Income Statement – IFRS Presentation (generic example)

STATEMENT OF COMPREHENSIVE INCOME (STATEMENT OF PROFIT OR LOSS)

for the financial year ended __/__/____

I – OPERATING PRODUCTS (Revenue)

– Turnover (Revenue from contracts with customers)

– Other operating income

II – OPERATING EXPENSES

– Cost of sales

– Sales and distribution expenses

– Administrative expenses

– Research and development costs (if applicable)

– Other operating expenses

→ **Operating profit**

III – FINANCIAL PRODUCTS AND CHARGES (Finance income / Finance costs)

– Financial products (Finance income)

– Financial costs

→ **Profit before tax**

IV – INCOME TAX EXPENSE

→ **NET RESULT FOR THE PERIOD (Profit for the period)**

V – OTHER COMPREHENSIVE INCOME

– Conversion differences

– Actuarial gains/losses on defined benefit plans

– Change in fair value of financial instruments

– Tax relating to the above items

→ **TOTAL COMPREHENSIVE INCOME**

(including share returning to shareholders and share returning to minority interests if necessary)

🇫🇷 French diagram of the Income Statement (General Chart of Accounts)

Turnover

– Direct costs (purchases, materials, subcontracting)

——————————–

= Gross margin

– Operating expenses (salaries, rent, etc.)

+ Operating subsidies

– Taxes and duties

——————————–

= Gross Operating Surplus (GOS)

– Depreciation and operating provisions

+ Reversals of operating provisions

+ Other operating income

– Other operating expenses

——————————–

= Operating profit (EBIT)

+ Financial Products

– Financial charges

——————————–

= Current profit before tax (CBT)

± Exceptional result

– Profits tax

——————————–

= Net result

🇬🇧 Anglo-Saxon model of the Income Statement (Financial Reporting)

Revenue (CA)

– Cost of Goods Sold (COGS)

——————————–

= Gross Margin

– Operating expenses (OPEX, excluding depreciation)

——————————–

= EBITDA

– Depreciation & Amortization

——————————–

= EBIT

– Interest expenses

+ Financial income

——————————–

= EBT (Earnings Before Taxes)

– Taxes

——————————–

= Net Income

It is this "final" net result that will be recorded as a liability on a company's balance sheet.. If it is positive, it will positively "feed" the company's resources, and a decision must then be made on how to use this money (carried forward, reserves, dividends, etc.). If it is negative, it will decrease the amount of equity, with the possibility that this equity could become negative if losses exceed the available equity. The negative amount of equity on a balance sheet is the financial representation of the losses incurred by the company.

Indicator correspondence

Here is a small table of approximate equivalents between French profit and loss accounts and Anglo-Saxon reporting:

| French concept | Approximate Anglo-Saxon equivalent |

|---|---|

| EBITDA | EBITDA |

| REX | EBIT |

| RCAI | EBT |

| Net result | Net Income |

Now that we have understood how to establish and read an income statement, we will discover in the next chapter what indicators can be extracted from the income statement, in order to estimate the financial health of a company and especially its profitability for the year covered by the income statement.

Feel free to subscribe to the blog and comment, and I'll see you soon for the next chapter,

👉 Next chapter: Understanding the balance sheet

📖 Back to Table of Contents