In this new course taken from the Complete Guide to Business Management, we will discover together the liquidity and solvency ratios, always with the aim of becoming knowledgeable in management and corporate finance, especially for beginners, managers and especially entrepreneurs who would like to create or develop their business without falling into management traps.

This content is part of the course “Business Management for Entrepreneurs: A Complete Course to Better Manage Your Business” find it on Tulipemedia.com 💰📈

First, let's quickly recall what we learned in the previous chapters about the functional assessment, then let's define together very simply what the liquidity and the solvency of a company, which are concepts relating to ratios which make it possible to evaluate the financial health of a company.

Reminder on the functional assessment

As a reminder, the functional balance sheet is a rereading of the classic accounting balance sheet in the form of balance sheet masses relevant from a financial point of view. The positions are reclassified according to their function in the operating cycle (investment, operation, financing), which makes it possible to produce a financial structure analysis, autonomy and balance of the company.

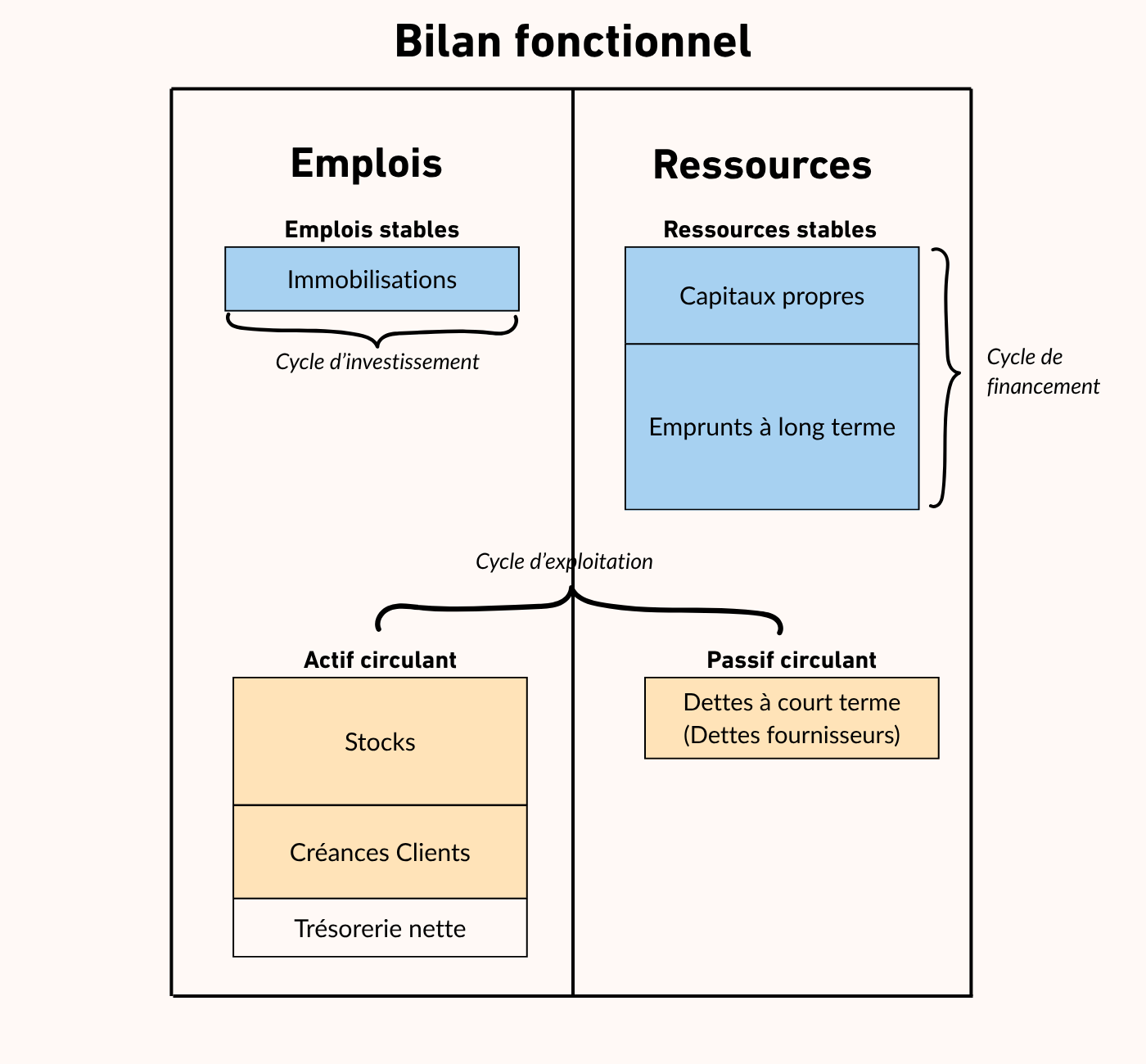

In the functional assessment, we can identify the resources and long-term jobs on one side, and on the other the short-term resources (or current liabilities) as well as the company's relatively liquid assets (current assets).

It is generally said that ideally, the long-term resources should be able to finance at least long-term jobs (this is the working capital), which ensures the solvency of the company by guaranteeing that fixed assets, which are less liquid, are covered by stable funding (and not through current liabilities), thus reducing the risk of short-term insolvency.

Do you have a business and want to regain control of your margins and your business model? Discover my solution Ultimate Business Dashboard which transforms your raw accounting data into performance indicators and a monthly dashboard.

We have seen all this in the previous chapters of this business management guideThis reminder of the functional balance sheet allows us to better understand the subtleties relating to solvency, because the measurement of the latter results from the balance between the different balance sheets.

Definition of the solvency ratio

Let us now move on to the definition of solvency, and solvency ratios. solvency actually measures the a company's ability to meet its debts as they fall due, whether short, medium or long term.

It reflects the overall financial strength of the company, especially in the long term, unlike liquidity, which focuses on the ability to face the short-term commitments.

It's an approach heritage And theoretical : the company is not supposed to repay everything immediately, but we check whether, overall, it has “assets” greater than its debts.

Financial institutions often use solvency ratios For assess capacity of a borrower to repay a loan before granting it. These ratios reflect both:

- the company's ability to cover all of its financial commitments with its assets (heritage approach),

- and its ability to sustainably finance its needs thanks to its stable resources, in particular its equity (structural approach).

In this chapter we will focus on the'patrimonial approach to solvency', which compares the company assets and liabilitiesThe structural approach, based on the balance between stable resources and stable jobs, has already been discussed in the chapter on Working capital and working capital requirement, as well as in the chapter on debt ratios.

Main solvency ratios

There are several accounting ratios that can be used to assess a company's solvency. These include: financial autonomy ratios, already discussed in the previous chapter, such as:

Debt ratio = Net financial debt / Equity

This ratio measures the dependence of the company on its creditors. THE net financial debts generally correspond to the borrowings and financial liabilities less cash and liquid assetsA high ratio indicates high debt.

Next, we have the financial autonomy ratio, also discussed in the previous chapter on debt :

Financial autonomy ratio = Equity / Permanent capital

THE permanent capital include as a reminder equity and long-term debtI am putting here a second time the diagram on the balance sheet with FR and BFR in order to visualize the balance sheet masses and thus better understand the ratios discussed.

This ratio assesses the share of equity in the stable financing of the company. A high ratio indicates good financial autonomy.

In addition to these ratios, we finally have a new ratio that we discover here which is the general solvency ratio. He is a key indicator and its formula is as follows:

General solvency ratio = Total assets / Current liabilities

THE current liabilities corresponds to everything the company owes to Liabilities, therefore financial debts, supplier debts, tax debts, etc.

This ratio measures the ability of the company's total assets to cover all debts (short, medium and long term):

- A ratio greater than 1 indicates that the company has sufficient assets to cover all of its debts, which is a sign of solvency.

- A ratio below 1, although rare, can occur in the case of negative equity, for example after several years of losses.

Be careful, when we say that "assets cover debts", we should not see this as a financing link: in reality, it is the debts and the equity (the liabilities) which finance the assets. Except that here, we reason more in terms of guarantee value: Would the assets owned by the company be sufficient to repay what it owes?

Example of a positive solvency ratio

If a company has total assets of €1,000,000 and current liabilities of €600,000, its current ratio is 1.67, which reflects good solvency.

Example of a negative solvency ratio

Balance sheet of a company with negative equity:

- Total assets: €800,000 (fixed assets + cash + receivables)

- Current liabilities: €900,000 (loans + supplier debts)

- Equity: -€100,000 (cumulative losses exceeded capital and reserves resulting in a negative value in liabilities).

In this example, the balance sheet is balanced, with €800,000 on each side. Except that if we calculate the general solvency ratio, we have:

General solvency ratio = Total assets / Current liabilities = €800,000 / €900,000 = 0.89

The ratio is therefore logically less than 1: the company does not have enough assets to cover its debts and the ratio reflects a situation of potential insolvency.

Another specific ratio is sometimes used:

Financial debt coverage ratio = Total assets / Financial debt

This ratio assesses the ability of assets to cover financial debts (bank loans, bonds, etc.). This therefore concerns financial debts and not debts related to operations, such as supplier debts, for example.

A ratio greater than 1 means that assets exceed financial liabilities, strengthening solvency.

However, this ratio does not take into account the liquidity of assets, which can limit the actual repayment capacity (which will bring us to the upcoming section on liquidity, i.e. the ability to raise money from short-term assets).

Interpretation of the general solvency ratio

In summary, if the general solvency ratio (or financial debt coverage) is greater than 1, this can be interpreted as a positive indicator, because it shows that the company can theoretically repay its debts by mobilizing its assets.

However, a thorough analysis must include other factors, such as the liquidity of assets and the company's ability to generate cash flow.

A ratio below 1, for example in the case of negative equity due to cumulative losses, signals a risk of insolvency.

Definition of the liquidity ratio

THE liquidity ratios measure the ability from one company to another honor its short-term financial commitments (less than one year), such as supplier debts, salaries, or VAT.

There liquidity represents the cash availability Or assets quickly convertible into cash (such as short-term trade receivables or negotiable investments) for cover current liabilities (short-term debts).

Here is the balance sheet diagram with FR and WCR for the third time in order to always keep in mind the articulation of balance sheet masses and thus fully understand the principles of liquid assets (represented in the diagram by stocks, customer receivables and cash) and current liabilities (represented by short-term debts, generally supplier debts but this can also include tax and social security debts, VAT, etc.).

Without sufficient liquidity, a company, even if solvent in the long term, risks defaulting on payments in the short term. For example, a company with many fixed assets but little cash may be solvent (able to cover its total long-term debts) but lack the liquidity to pay its suppliers in the short term.

Here, unlike the notion of solvency, we are in a more concrete and operational logic: can the company pay its invoices in the coming days or months?

The different liquidity ratios

There are several liquidity ratios, which will measure the liquidity of a company in the more or less long term.

Current ratio

The current ratio includes all liquidity and allows to measure the a company's ability to cover its short-term debts (current liabilities) with all of its current assetsTo obtain it, it is therefore sufficient to divide the current assets by the current liabilities:

Current ratio = Current assets / Current liabilities

The interpretation of this general liquidity ratio is quite simple:

- A ratio greater than 1 means that the company has more current assets than current liabilities, which is a sign of good short-term financial health;

- If it is below 1, the liquidity ratio raises fears of difficulties in covering short-term obligations with current assets;

- If it is greater than 2, the ratio may suggest an excessive accumulation of cash or unused current assets, which could be invested more productively, according to the company's strategy.

The target value for this ratio depends on the industry. For example, construction or real estate companies, which hold large inventories, often need a high ratio (> 1.5) to ensure their liquidity. They therefore have little short-term debt compared to their inventories and receivables. On the other hand, consulting firms, with rapid collection cycles, can operate with a lower ratio (for example, 0.8), because they have little inventory, few receivables (since clients pay quickly), and short-term debt that is sometimes higher than current assets.

Restricted or reduced liquidity ratio

THE tight liquidity ratio, also called the tight liquidity ratio, is a financial indicator that measures the a company's ability to repay its short-term debts without having to sell its inventory.

To calculate it, it is therefore sufficient to remove the value of the stocks from the current assets, before dividing by the liabilities:

Tight Liquidity Ratio = (Current Assets – Inventories) / Current Liabilities

The purpose of this ratio is to measure the company's ability to repay its short-term debts through its cash, without having to sell its inventory.

- A tight liquidity ratio close to 1 or higher indicates that the company can cover its short-term liabilities with its cash and receivables, without relying on inventory.

- A ratio less than 1 suggests a dependence on stock flow For repay short-term debts, which can be problematic if inventory is slow to sell. Indeed, since we have isolated inventory from the calculation, and the company cannot cover its short-term liabilities with its accounts receivable and cash, it needs to add its inventory back into the calculation (by valuing it as a liquid asset) in order to increase its liquidity ratio.

- The acceptable value depends on the sector: in large-scale distribution, where stocks sell quickly, a ratio < 1 can be tolerated, because stocks sell fairly quickly, customers pay cash and suppliers are paid in installments.

The tight liquidity ratio is therefore stricter than the current ratio, as it excludes inventories. This is because inventories can take time to convert into cash depending on the business sector, so this ratio can be relevant to assess a company's liquidity level independently of its inventories.

Quick liquidity ratio

Finally, we have the immediate liquidity ratio, which is the strictest of the liquidity ratios. This will measure the company's ability to cover its current liabilities with only its cash and short-term investments.

Quick Liquidity Ratio = Cash + Short-Term Investments / Current Liabilities

By focusing only on directly actionable cash, this ratio makes it possible to identify debts that can be settled without waiting for the collection of customer receivables or the disposal of stocks.

- If this ratio is greater than 1, it will obviously be a sign of good financial health because it will mean that the company can pay its short-term debts without waiting for the recovery of receivables or the sale of stocks.

- A ratio below 1 is common, especially in industries where cash collections are rapid (such as retail, where customers pay cash). The minimum acceptable value varies depending on the industry and the company's cash collection cycle.

In general, the shorter the collection cycle (i.e. low customer receivables and, for what interests us here, relatively low available cash), the more a low ratio is considered acceptable (as in the distribution trade, for example).

This can be explained by the fact that the company collects money from its customers very quickly (short collection cycle), and therefore does not need to store a lot of cash since the money is constantly coming in.

Conversely, a company that has to wait 90 days to be paid should keep more cash on hand to cover its short-term liabilities, so a higher quick ratio is generally expected.

Interest in liquidity ratios

Liquidity ratios are essential tools for assessing the short-term financial health of a companyTheir target value depends on the sector, the activity, and the strategic objectives of the company.

These ratios are used to:

- Anticipate cash flow difficulties: A ratio that is too low (for example, a current ratio < 1) signals a risk of cash flow tension, making the company vulnerable to unforeseen events.

- Building stakeholder confidence: Healthy ratios facilitate access to financing (bank loans, investor confidence) by demonstrating good liquidity management.

- Optimize resource allocation: An excessively high ratio may indicate underutilization of cash, which could be reinvested (for example, in development projects).

In combination with solvency ratios, liquidity ratios provide a comprehensive view of the company's financial health, enabling managers to manage effectively and anticipate risks.

Difference between solvency and liquidity

As we have seen, the fundamental difference between the liquidity and the solvency resides in the period taken into account :

- There liquidity measure the ability of a company to honor its commitments to short term (less than a year), thanks to its current assets (cash, accounts receivable, etc.)

- There solvency, on the other hand, evaluates the ability to cover all of its debts long term, based on all its assets And its financial structure.

Concretely, a company can lack immediate cash (i.e. having little cash or assets easily convertible into cash) while remaining solvent, i.e. able to cover its long-term debts thanks to long-term assets (fixed assets) and stable resources (equity and long-term borrowing). For example, a company with a valuable building but little cash may be solvent, but lack the liquidity to pay its suppliers in the short term.

There solvency in the long term is based on a balanced financial structure, where long-term resources (equity and long-term debt) finance at least long-term jobs (fixed assets), with a positive overall net working capital (which makes it possible to finance part of the current assets).

This ensures that illiquid assets, like fixed assets, are financed by stable resources, reducing the risk of insolvencyIf fixed assets exceeded long-term resources, the company would have to resort to short-term debt, which would weaken its solvency by increasing the risk of cash flow difficulties.

Example of calculation and analysis of a company's solvency

A company has:

- Fixed assets (long-term jobs): €400,000

- Current assets (short-term uses): €200,000

- Equity: €300,000

- Long-term debt: €200,000

- Short-term debts: €100,000

In order to analyze the solvency of this company, let us first calculate its overall net working capital:

Total net working capital (TNWC) = Long-term resources – Long-term uses = (€300,000 + €200,000) – €400,000 = €100,000.

The FRNG is positive, which is a good sign. Now let's calculate the general solvency ratio to get a better idea of the financial health of this company:

General solvency ratio = Total assets / Current liabilities = (€400,000 + €200,000) / (€200,000 + €100,000) = €600,000 / €300,000 = 2.

Interpretation:

- Long-term resources (€500,000) largely cover fixed assets (€400,000), which indicates a balanced financial structure.

- The positive FRNG (€100,000) shows that the company can finance part of its current assets with stable resources, strengthening its solvency.

- If fixed assets were €600,000 (higher than long-term resources of €500,000), the FRNG would be negative (-€100,000), forcing the company to finance its fixed assets with short-term debts, which would weaken its solvency.

Conclusion

In summary, the solvency and liquidity ratios are complementary to assess the financial health of a companySolvency reflects the company's ability to meet all of its debts over the long term, while liquidity focuses on its immediate ability to meet its short-term deadlines.

A good balance between the two is essential: a company can be solvent but lack liquidity, and conversely have cash without guaranteeing its financial solidity over time. This is why it is important to interpret these ratios not in isolation, but as a whole and taking into account the sector of activity.

In the next chapters, we will delve deeper into financial analysis with other key indicators, in order to consolidate this global vision essential for effectively managing a business!

Corrected exercises on solvency and liquidity

Exercise 1

A company presents the following data:

- Total assets: €1,500,000

- Debts due: €900,000

- Available cash: €100,000

1/ Calculate the general solvency ratio.

2/ Interpret the result.

3/ Calculate the immediate liquidity ratio (cash / payable debts).

4/ Comment on the company's liquidity.

Correction:

1/ Solvency ratio = 1,500,000 / 900,000 = 1,67

2/ Interpretation: a ratio > 1 indicates that the company has sufficient assets to cover all of its debts. It is generally solvent.

3/ Immediate liquidity ratio = 100,000 / 900,000 = 0,11

4/ Comment: immediate liquidity is low, the company could encounter difficulties in repaying its due debts with its available cash alone.

Exercise 2 – Analysis of the level of debt and financial structure

A company presents the following data:

- Equity: €800,000

- Long-term financial debts: €1,000,000

- Short-term debts (suppliers, tax and social security debts): €200,000

- Available cash: €200,000

- Total assets: €2,000,000

Questions :

- Calculate net financial debts.

- Calculate the debt ratio.

- Interpret this ratio in a few lines.

- Calculate the portion of the asset financed by the stable resources.

- Calculate the portion of the asset financed by the equity only.

- Interpret these last two ratios and draw a general conclusion about the financial structure of the company.

Correction:

1/ Calculation of net financial debts:

Net financial debts = Long-term financial debts – Cash = €1,000,000 – €200,000 = 800 000 €

2/ Calculation of the debt ratio:

Debt ratio = 800,000 / 800,000 = 1.0 → 100 %

3/ Interpretation of the ratio:

- A debt ratio of 100 % means that net financial debts are equivalent to equity.

- The company therefore has a balanced structure between its own and borrowed financing.

- The situation is acceptable if the economic profitability remains higher than the cost of debt, but the room for maneuver for new debt remains limited.

4/ Calculation of the share of assets financed by stable resources:

Stable resources = Equity + Financial debts LT = 800,000 + 1,000,000 = 1 800 000 €

Share of assets financed by stable resources = 1,800,000 / 2,000,000 = 0.9 → 90 %

5/ Calculation of the portion of assets financed by equity alone:

Equity / Total assets = 800,000 / 2,000,000 = 0.4 → 40 %

6/ Interpretation:

- Stable Resources / Assets = 90 %: Almost all assets are financed by sustainable resources. The company is therefore only marginally dependent on short-term - healthy financial structure.

- Equity / Assets = 40 %: financial autonomy is correct, but the company remains significantly financed by long-term debt.

- Overall reading: resources are stable (good long-term solvency), but the share of equity remains moderate. The company must ensure that it maintains a sufficient level of profitability to secure its repayment capacity.

💡 Educational note:

This exercise combines two complementary approaches:

- THE debt ratio measures the company's dependence on external financing.

- THE structural ratios (stable resources / assets and equity / assets) measure the strength and autonomy of overall financing.

Together, they allow us to appreciate the long-term solvency and the financial structure of the company.

Exercise 3

A company presents the following data:

- Current assets: €500,000

- Short-term debts: €400,000

- Cash: €80,000

1/ Calculate the general liquidity ratio.

2/ Calculate the immediate liquidity ratio.

3/ Comment on the results in terms of the company's ability to meet its short-term debts.

Correction:

1/ Current ratio = 500,000 / 400,000 = 1,25

2/ Immediate liquidity ratio = 80,000 / 400,000 = 0,2

3/ Comment: General liquidity is adequate; the company can cover its short-term debts with its current assets. Immediate liquidity is low, meaning that in the event of immediate repayment, cash alone would be insufficient.

Exercise 4

A company has the following data:

- Total assets: €1,200,000

- Debts due: €1,500,000

- Cash: €200,000

1/ Calculate the general solvency ratio.

2/ Interpret the result.

3/ Analyze the company's ability to immediately meet its debts with available cash.

Correction:

1/ Solvency ratio = 1,200,000 / 1,500,000 = 0,8

2/ Interpretation: ratio < 1 indicates that total assets are lower than payable debts. The company is theoretically insolvent at this level.

3/ Cash flow analysis: the cash flow of €200,000 only covers part of the debts (200,000 / 1,500,000 = 13.3 %). The company cannot therefore immediately meet all of its debts.

👉 Next chapter: Complete course on profitability ratios (ROE, ROA, ROCE, ROIC, ROS and DuPont)

📖 Back to Table of Contents