In this new course taken from the Complete Guide to Business Management, we will learn what are debt ratios, their interest, their method of calculation, the way of interpreting them, always with the aim of training us in finance and business management.

This content is part of the course “Business Management for Entrepreneurs: A Complete Course to Better Manage Your Business” find it on Tulipemedia.com 💰📈

Definition of debt ratio

THE debt ratio is as its name suggests, a ratio (therefore a relationship between two orders of magnitude) which measures the level of debt of a company compared to its equity.

Expressed as a percentage, this ratio allows to assess the level of financial dependence of the company towards third parties and its ability to repay its debts.

As we discussed in the previous chapter on leverage, companies can have use of debt to finance their investments, rather than through own funds. This allows in particular to improve the return on equity, so the shareholders' profit, because if we had to put it schematically, they bet less for more income through debt than through a contribution of equity.

It works as long as the return on the economic asset is higher than the cost of borrowing, that is to say at the interest rate multiplied by the amount of the debt, which is the amount which allows the financial institution which lent this money to be remunerated.

Do you have a business and want to regain control of your margins and your business model? Discover my solution Ultimate Business Dashboard which transforms your raw accounting data into performance indicators and a monthly dashboard.

Now that we have said that, we understand the interest of the debt ratio, or rather debt ratios because there are several: they actually measure the level of financial dependence of the company towards third parties who have lent money to the company.

The more debt-dependent the company is, the more vulnerable it can become., because its economic assets become increasingly dependent on debt and therefore on third parties, who are external actors to the company, and whose interest is to be remunerated on the loan that they have granted to the company, whatever the impacts that this could have on this company.

Main formula of debt ratio

The basic formula for the debt ratio is quite simple:

Debt ratio = Net financial debt / Equity

Debts generally include long-term debts (therefore mainly bank loans) and short-term debts (current bank loans and loans of less than one year), even if sometimes, in certain courses, it may happen that only long-term financial debts are included in the ratio, for the sake of simplification.

In any case, we exclude supplier debts or even tax and social security debts. The idea is to know the extent to which the company is at the mercy of borrowing from financial institutions to finance its activity.

Then, regarding Net Financial Debts, you should know that:

Net financial debt = Financial debt − Available cash

With :

- Financial debts: bank loans, bonds, current accounts of remunerated partners... in short, everything the company owes to lenders.

- Available cash: immediately available liquidity (cash, positive bank accounts, highly liquid investments).

Why “nets”?

- The term "net" indicates that available cash is subtracted from gross financial liabilities.

- The goal is to obtain a real vision of debt, that's to say what would remain to be repaid if the company used all its available cash.

Finally, equity, as a reminder, brings together the company's internal resources. It is notably composed of:

- shareholder contributions;

- of the net result generated;

- and reserves of profits reinvested in the company.

Interpretation of the debt ratio

The interpretation of the debt ratio is quite simple, although depending on the context, one could justify the different results. But to simplify:

- if the debt ratio is greater than 1, this means that debt is greater than equity. This means that financial institutions bear more of the risk associated with the company's activity (and its possible success or failure) than shareholders. In such a case, the company is in a somewhat vulnerable situation vis-à-vis lenders.

- if the debt ratio is less than 1, it is estimated that the company's debt capacity is adequateEquity is greater than borrowings. This provides room to further exploit credit leverage if needed.

In theory, the "best" situation is one where shareholders bear the risk, not lenders, because lenders are not the owners of the company.

However, as we saw in the chapter on leverage, if leverage is positive, and the profitability of the company is much higher than the cost of debt, then the owners of the company could afford to borrow more in order to finance an investment that is supposed to be successful, because their financial profitability (the famous return on equity) will be higher than what they would have had if they had financed this same investment solely through equity alone.

In general, it is said thata debt ratio of 0.5 (therefore double the equity compared to net financial debts) expresses a well-exploited debt capacity without major risk for the company.

The debt ratio

In some financial analyses, the debt ratio calculation is extended to include all of the company's debts, not just financial debts. This gives the ratio:

Debt ratio = Total debt / Equity

This ratio therefore also includes supplier, tax and social security debts, unlike the previous one. It gives a vision more global of the company's debt to its own resources, but it can sometimes "overload" the perception of risk, because these operating debts (suppliers, VAT, social security contributions, etc.) are part of the normal cycle of activity and are less problematic than long-term bank debt.

It is sometimes said that a maximum debt ratio of 33% can be used to limit the granting of loans to a company. In other words, the company's debt capacity would be restricted if it was already indebted to the tune of 33% of its equity. But this is not a rule, and everything depends on the context, the potential of the project, the relationship with the bank, etc.

Financial autonomy

Among the other ratios that arise from the first, we find in particular the financial autonomy ratios, which calculate how financially independent the company is from lenders.

We thus have a first ratio which is calculated as follows:

AF1 = Equity / Permanent capital

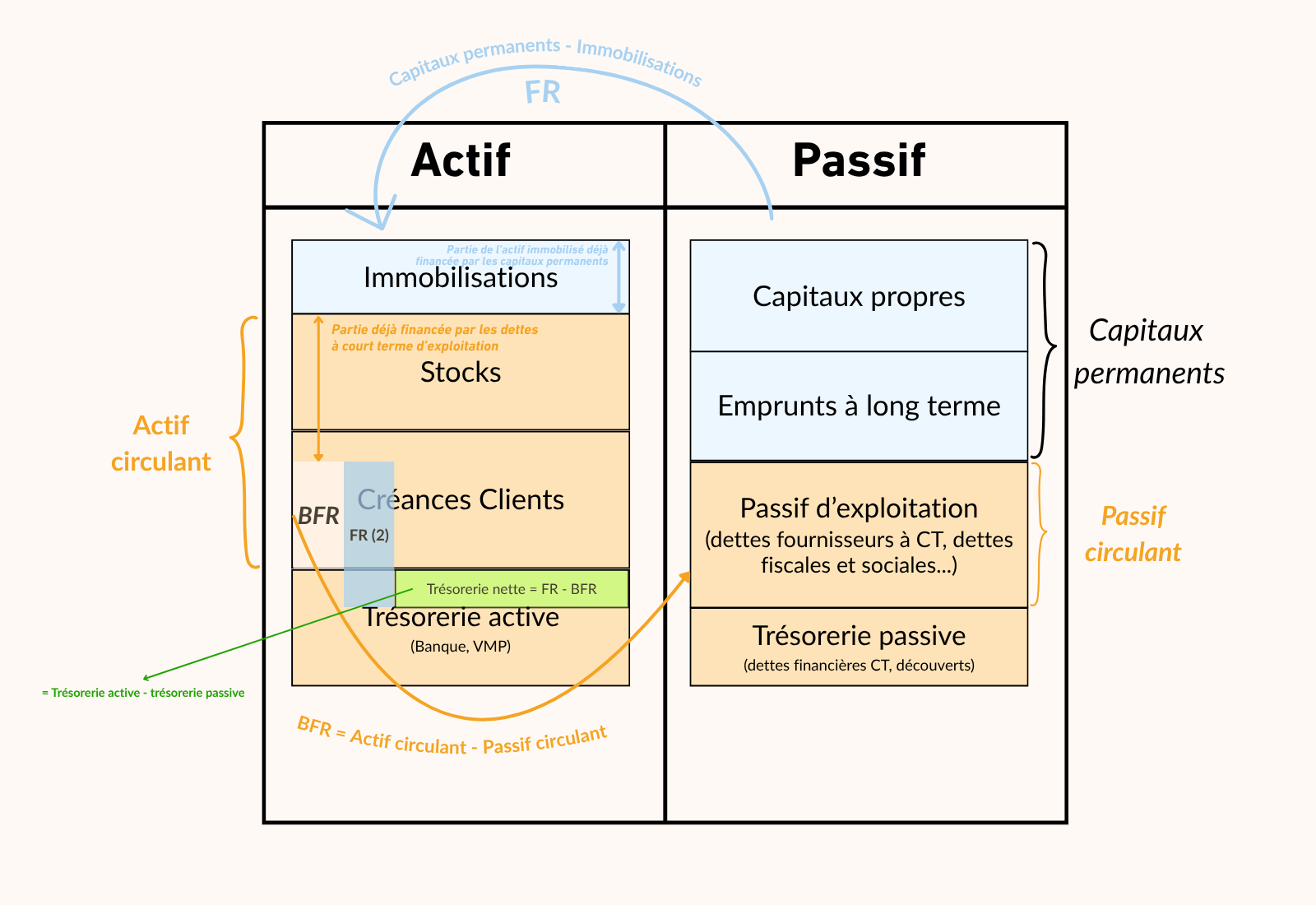

Permanent capital being a reminder equity + long-term debt (often loans of more than one year).

This ratio therefore measures the weight that equity represents on the total long-term liabilities (permanent capital, also called stable resources, which are supposed to finance fixed assets, as can be seen in the diagram above).

Ideally, from a purely theoretical point of view, it is better that it is equal to at least 0.5 (so 1/2) because that would mean that equity represents at least half of stable resourcesFor example, if equity represents exactly half of permanent capital, let's say for example €20,000 of equity and €40,000 of permanent capital:

AF1 = Equity / Permanent capital = 20,000 / 40,000 = 50%

And Debt Ratio = Debt / Equity = €20,000 / €20,000 = 1

The debt ratio would be equal to 1, since as the equity of €20,000 represents half of the permanent capital, the debts which are the other half would amount to €20,000. The company's activity is therefore based equally on financing in equity and financial debt.

Then we have a second financial autonomy ratio which is calculated as follows:

AF2 = Equity / Short-term and long-term debt

This ratio therefore calculates the weight of equity on total financial debts, whether they are long term or short term, unlike the first ratio which only took into account long-term debts (which are included in permanent capital).

This ratio therefore measures the company's ability to finance its activity by its own means in relation to loans, whatever they may be. Ideally, it should be greater than or equal to 1, so that equity covers at least all financial debts.

Industry standards and comparisons

As with most financial ratios, the interpretation of the debt ratio depends heavily on the sector of activitySome activities structurally require a lot of debt to finance their investments (real estate, energy, transport, construction, etc.), while other sectors that are lighter in capital (services, consulting, technologies) operate with very little debt.

👉 So, a ratio of 150 % might seem excessive for a consulting company, but be perfectly normal for a real estate developer.

👉 The important thing is therefore not to judge a ratio in absolute terms, but to compare it:

- to the history of the company itself (evolution over time),

- to companies in the same sector (sector comparison).

Limits of the debt ratio

Although useful and simple to calculate, the debt ratio has several limitations:

- It does not measure actual repayment capacity. A company may have a high debt load, but stable cash flows that allow it to meet its repayments without any problems.

- It does not take into account the cost of debt. High debt at low interest rates can be less risky than lower but costly debt.

- It can give a distorted image depending on the definition used. Including or not including operating debts significantly changes the result.

- Finally, it must always be put into perspective with other ratios, notably the ratio Net debt / EBITDA, which more directly measures the company's ability to repay its debt through its operating profitability.

In summary, the debt ratio is a basic indicator, useful for an initial diagnosis, but it should never be analyzed alone.

The Net Debt / EBITDA ratio

To complete the debt analysis, financial analysts and banks frequently use the following ratio:

Net debt / EBITDA.

In this ratio:

- Net debt = Financial debts – Available cash, because we are interested here in what the company can quickly mobilize if it wanted to repay its debts, so we subtract the available cash from the debts in order to assess the company's true exposure to debt.

- EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) = operating profit before depreciation and provisions, which reflects the profitability generated by the company's current activity.

👉 This ratio measures how many years of EBITDA it would take the company to fully repay its net debt, assuming it devotes all of its operating profitability to it.

Example :

- Net debt = €20 million

- EBITDA = €5 million

- Ratio = 20 / 5 = 4

This means that it would take 4 years of EBITDA to repay the net debt.

In practice:

- A ratio less than 3 is often considered comfortable.

- Beyond 5, lenders generally consider the company to be too leveraged.

This ratio is particularly used in financing and LBO (leveraged buyout) transactions, because it directly reflects the company's repayment capacity.

In France, one of the ratios that comes close to EBIDTA is EBE, gross operating surplus, which measures the wealth created by current activity before taking into account depreciation, provisions, financial charges and taxes, but all of this will be the subject of a dedicated chapter.

International comparison: gearing and leverage

In Anglo-Saxon financial literature, we find terms similar to the French debt ratio, even if the definitions can vary depending on the context:

- Gearing ratio : it often corresponds to the ratio of financial debts to equity, as in the classic French definition. In some cases, it can include all debts.

- Leverage ratio : more broadly, this term can refer to all measures of leverage, including the ratio between debt and profitability or the size of the balance sheet.

👉 The important thing to remember is that the vocabulary differs, and you should always check the exact formula used in financial or banking documents. Two people may use the same word (“leverage”) to refer to two different ratios.

Debt capacity

There debt capacity of a company (or borrowing capacity) corresponds to its ability to contract new bank loans without jeopardizing its financial balance and therefore its profitability. This is an essential criterion both for deciding to borrow on the company's side, but also for lending to the company on the financial institution's side.

This debt capacity depends on the criteria listed above. And to improve it, the company can seek to increase its results and therefore its self-financing capacity (the difference between the income collected and the expenses generated by its activity, therefore the cash surplus over a given period, allowing the company to cover its expenses or to invest without resorting to external financing) and/or reduce debt by making early repayments if it can support it through its available cash, without jeopardizing the latter.

Corrected exercises on the debt ratio

Exercise 1

A company presents the following data:

- Financial debts: €400,000

- Available cash: €100,000

- Equity: €600,000

1/ Calculate the debt ratio (Net financial debt / Equity).

2/ Interpret the ratio.

3/ Debt capacity: can the company still borrow in theory if we base ourselves only on this ratio?

4/ Put the interpretation of the debt ratio into perspective.

Correction:

1/ Net financial debts = 400,000 – 100,000 = €300,000

Debt ratio = 300,000 / 600,000 = 0.5 → 50 %

2/ Interpretation of the ratio:

- The debt ratio is 0.5 (50 %), which means that net financial debts represent half of equity.

- The ratio being less than 1, the company is moderately indebted: its equity is greater than its net debt, the financial structure is therefore relatively healthy

3/ Yes. The company retains room to resort to new loans if necessary (its debt capacity is not saturated).

4/ However, the interpretation can vary in both directions depending on:

- the sector of activity: certain sectors (real estate, air transport, construction) support higher levels of debt, while others must remain more cautious.

- Return on equity: If the company generates a return higher than the cost of debt, the leverage effect can be positive. But if this return is low or lower than the cost of debt, debt can weaken the company.

Exercise 2

A company has €800,000 of equity and €1,200,000 of net financial debt.

1) Calculate the debt ratio.

2) Interpret the result in a few lines.

Correction:

1) Debt ratio = 1,200,000 / 800,000 = 1.5 → 150 %

2) With a debt-to-equity ratio greater than 1, the company relies more on borrowed capital than on capital provided by shareholders. This situation reflects an increased dependence on creditors.

- Risk: if the economic profitability of the company is lower than the cost of debt, the debt becomes penalizing and weakens the financial structure (negative leverage).

- Opportunity: Conversely, if the economic profitability is higher than the cost of debt, the company benefits from a positive leverage effect. Some capital-intensive sectors (e.g., construction, transportation, real estate) frequently resort to high levels of debt to finance their activities.

Exercise 3

A company has:

- Equity: €1,000,000

- Long-term debt: €600,000

Calculate the financial autonomy ratio AF1 and comment on the result.

Correction:

Permanent capital = 1,000,000 + 600,000 = €1,600,000

AF1 = 1,000,000 / 1,600,000 = 0.625 → 62,5 %

→ Result greater than 0.5: healthy financial situation.

👉 Next chapter: Solvency and liquidity ratios in corporate finance

📖 Back to Table of Contents