In this new course taken from my Complete Guide to Business Management, we will discover together the profitability ratios, always with the aim of becoming unbeatable in management and corporate finance, especially aimed at beginners, managers and entrepreneurs who would like to create or develop their business without falling into the traps associated with poor management.

This content is part of the course “Business Management for Entrepreneurs: A Complete Course to Better Manage Your Business” find it on Tulipemedia.com 💰📈

In the previous lesson, we discussed the concepts of solvency and liquidity., which allow us to establish ratios related to a company's balance sheet. Here, we will discover the profitability ratios, which allow us to measure the profitability of a project or a company, based on its balance sheet and income statement, and in connection with, as you will discover, leverage, which we have already discussed in the lesson dedicated to it.

We will also discover new concepts such as DuPont analysis, all while illustrating the calculations and formulas with simple examples and detailed explanations so that any layperson can become familiar with these concepts.

Ready? Let's go!

A simple definition of profitability

There profitability measure the performance of a company, by doing the report between the income obtained by this company, and the resources used to obtain this income. It is estimated using various ratios that highlight the performance of a company or a project in relation to the use of its financial resources, This is very useful in financial analysis to identify the reasons for success or failure, or when choosing whether to invest in a particular project, or whether to resort to debt or not.

Do you have a business and want to regain control of your margins and your business model? Discover my solution Ultimate Business Dashboard which transforms your raw accounting data into performance indicators and a monthly dashboard.

In other words, profitability indicates, for each sum of money invested, how much can it earn each year, And How long will it take to recoup the initial investment?, if the rate of return remains relatively stable.

But before going into detail about profitability ratios, it is important to do the distinction between profitability on the one hand, and profitability on the other hand.

Definition of profitability

Profitability measures the a company's ability to convert revenue into profit.

The profitability rate complements the return on investment ratio in a company's financial analysis. It is calculated very simply by... ratio between net income and revenue over a given period.

Profitability rate = Net income / Revenue

The higher the profitability rate, the more the company is able to convert its revenue into profit, and the symmetrically lower its costs are.

Put another way, it is simply the share of net profit generated on the revenue.

Difference between Profitability and Return on Investment

There Profitability measures a company's ability to generate profits for a given financial year, by calculating the ratio between Net Income and Revenue, regardless of the financing method, where profitability analyzes the company performance through the lens of resources deployed to generate results. We will look at the formulas relating to profitability a little later, but it is important at first to understand the concepts on a purely theoretical level.

Where the profitability measure the ability of a company (or project) to generate profits over a given period, depending on the revenue generated, the profitability She, for her part, is interested in return on investment by comparing a result obtained with the means that were used to obtain that result. These are therefore two notions that appear similar, but are quite different.

A reminder about the balance sheet and the income statement

In order to understand what the profitability ratios, It is important to remember the fundamentals, namely the balance sheet and the income statement. We will therefore conduct a recap to refresh our memories.

Summary of the results

The balance sheet is, in a way, a snapshot of the company's assets at a given date. (often on December 31st). He shows what the company owns (fixed assets, inventory, accounts receivable, cash) and what she owes (to its suppliers, its creditors, its shareholders).

The balance sheet is not intended to express the operational or commercial performance of a company, but rather to show what the company owns (assets), and the resources that allow it to finance this asset, whether it is a fixed asset (factory, goodwill, etc.) or a current asset, related to the operation of the company (purchases of raw materials, customer receivables, cash, etc.).

A reminder about the profit and loss statement

The income statement, on the other hand, reflects the activity over a given period. (usually a year). It shows how the company made or lost money.

So, in the end, it's the document that retraces the performance of the company over the year. And this performance is expressed in the form of different results, such as Gross Margin (margin on purchase of goods), EBITDA (or EBE in Anglo-Saxon countries, which expresses the profits of a company without taking into account the costs of interest, depreciation, taxes and amortization), and finally the current result before and after taxes.

🇫🇷 French diagram of the Income Statement (General Chart of Accounts)

Turnover

– Direct costs (purchases, materials, subcontracting)

——————————–

= Gross margin

– Operating expenses (salaries, rent, etc.)

+ Operating subsidies

– Taxes and duties

——————————–

= Gross Operating Surplus (GOS)

– Depreciation and operating provisions

+ Reversals of operating provisions

+ Other operating income

– Other operating expenses

——————————–

= Operating profit (EBIT)

+ Financial Products

– Financial charges

——————————–

= Current profit before tax (CBT)

± Exceptional result

– Profits tax

——————————–

= Net result

🇬🇧 Anglo-Saxon model of the Income Statement (Financial Reporting)

Revenue (CA)

– Cost of Goods Sold (COGS)

——————————–

= Gross Margin

– Operating expenses (OPEX, excluding depreciation)

——————————–

= EBITDA

– Depreciation & Amortization

——————————–

= EBIT

– Interest expenses

+ Financial income

——————————–

= EBT (Earnings Before Taxes)

– Taxes

——————————–

= Net Income

It is this "final" net result that will be recorded as a liability on a company's balance sheet.. If it is positive, it will positively "feed" the company's resources, and a decision must then be made on how to use this money (carried forward, reserves, dividends, etc.). If it is negative, it will decrease the amount of equity, with the possibility that this equity could become negative if losses exceed the available equity. The negative amount of equity on a balance sheet is the financial representation of the losses incurred by the company.

Indicator correspondence

Here is a small table of approximate equivalents between French profit and loss accounts and Anglo-Saxon reporting:

| French concept | Approximate Anglo-Saxon equivalent |

|---|---|

| EBITDA | EBITDA |

| REX | EBIT |

| RCAI | EBT |

| Net result | Net Income |

Reminder about the functional assessment

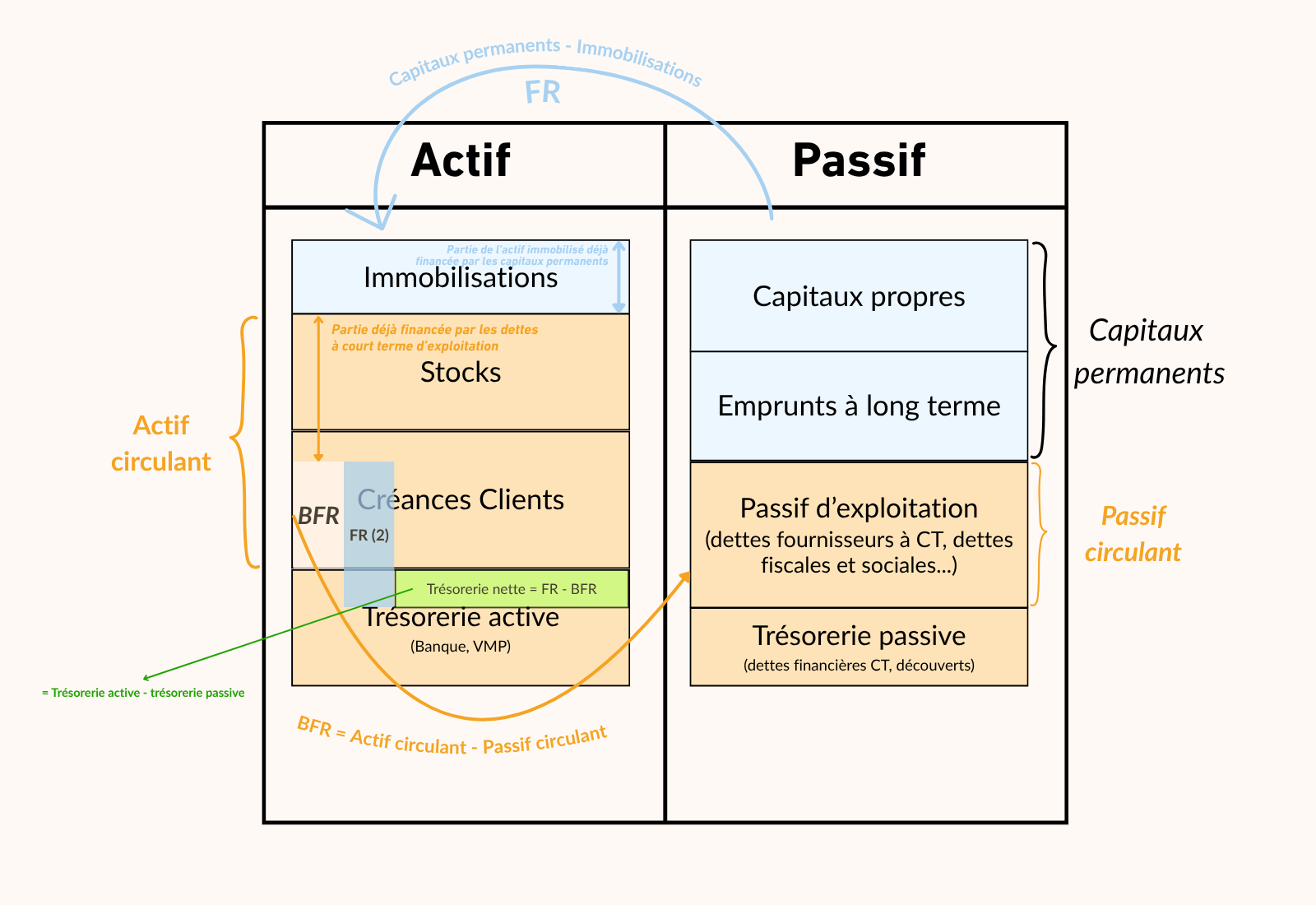

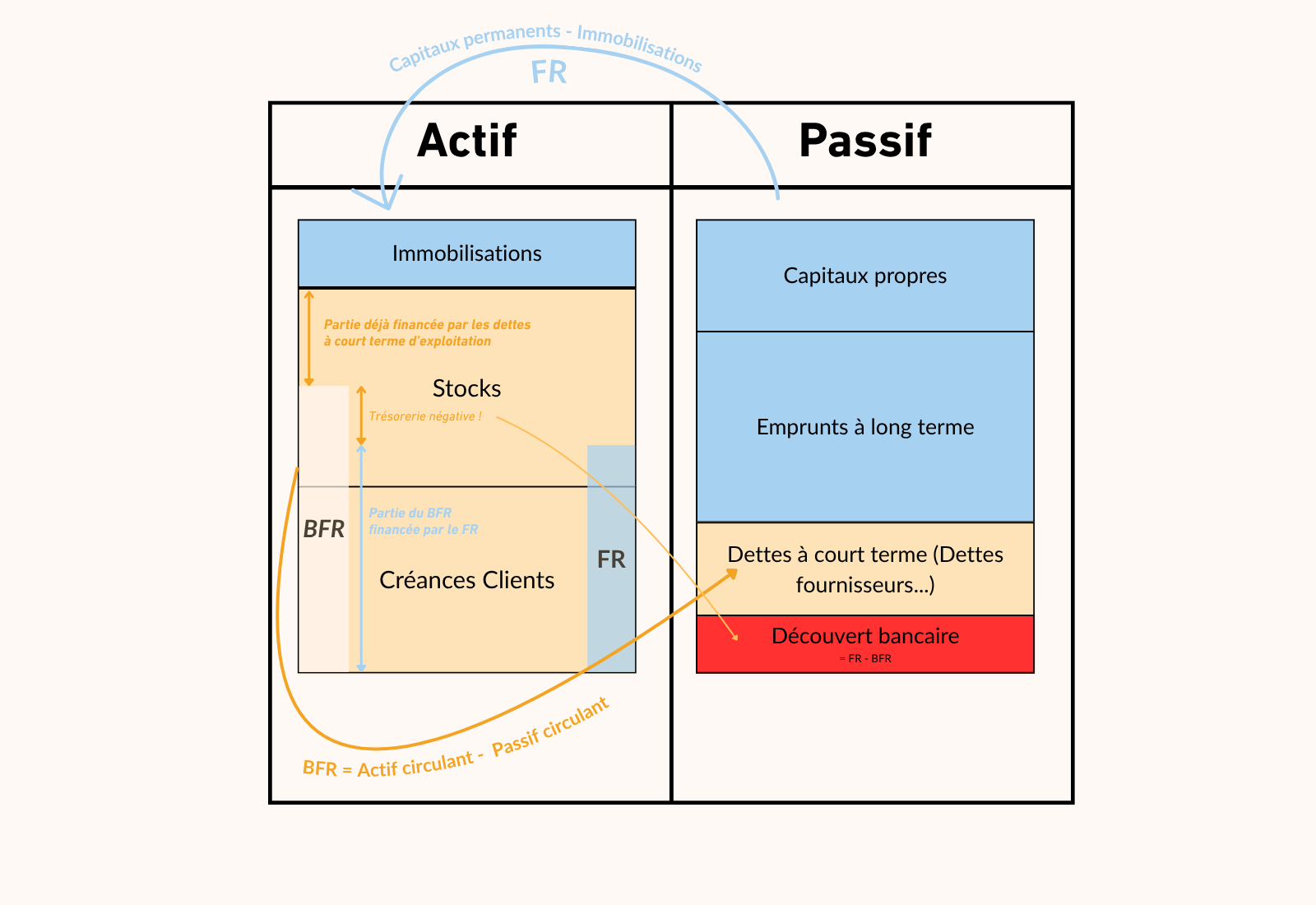

It is important to understand that the balance sheet consists of several major balance sheet masses, which allow us to distinguish:

- On the one hand, the positive side: fixed assets (all long-term assets), current assets more or less liquid, such as stocks, accounts receivable, and finally the active treasury which brings together available funds (cash and marketable securities); ;

- On the other side, in the passive voice: the permanent capital, which include equity and long-term debt, the current operating liabilities (which includes short-term debts related to operations such as supplier debts, wage debts, etc.), and finally the passive treasury (short-term financial debts such as bank overdrafts).

These balance sheet figures allow for a clearer understanding and analysis of the company's balance sheet in a slightly different form compared to the accounting balance sheet, and which is called the functional assessment.

| FUNCTIONAL ASSESSMENT – Theoretical Structure | |

|---|---|

| JOBS | RESOURCES |

Stable jobs

|

Stable resources

|

Current operating assets

|

Current operating liabilities

|

Active treasury

|

Passive treasury

|

Key points to remember:

- THE functional assessment groups the positions by cycle : stable, operation, cash flow.

- THE short-term financial debts are excluding working capital → in passive treasury.

- Note: some current assets/liabilities (e.g., miscellaneous receivables, liabilities on fixed assets) are non-operating and excluded from working capital requirements, but for the sake of simplification, we have not included them in this table.

Reminder about FR and BFR

Thanks to the functional assessment, we can verify if Fixed assets are adequately financed by permanent capital (working capital). ideally with a surplus to finance the company's operating cycle (current assets). If cash is freed up, it will be possible to see if it is being managed properly and how it is being reallocated.

On the contrary, if short-term debts (which are mainly supplier debts) are insufficient to cover current assets, which reflects too rapid a payment to suppliers compared to the payment to customers or the sale of stock, the company then needs cash to finance its operations, and it is a short-term loan or a bank overdraft (which often amounts to the same thing) that will be necessary to cover the payment delay to customers, or the sale of stock.

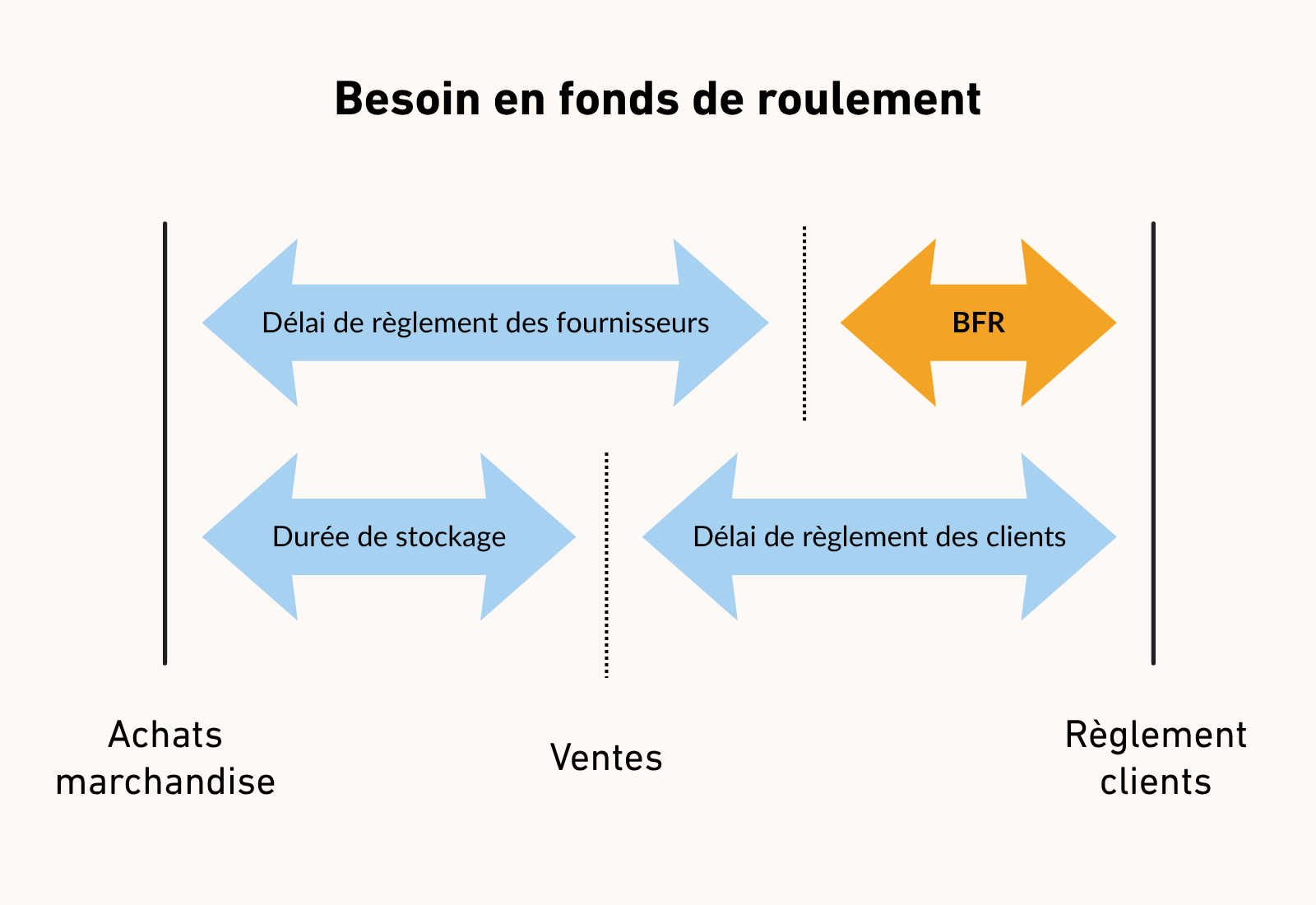

In practical terms, working capital requirement (WCR) reflects the financing need when, for a given quantity of current assets (inventory + accounts receivable), suppliers have already been paid, but customers have not yet paid the company and/or the inventory has not yet been sold. It is the period between supplier payments and sales and customer payments.

Cash flow then becomes the adjustment variable between working capital and working capital requirement:

Cash = FR-BFR

When it is positive, it means that working capital covers the working capital requirement. When it is negative, it means that accounts payable are not high enough to cover inventory and accounts receivable, and at the same time, working capital is insufficient to cover this requirement. This can be due to either inventory not moving quickly enough, customers not paying or not paying on time, or suppliers being paid too quickly compared to customers. It could also be a combination of all three factors.

We had seen all of this in the chapter dedicated to working capital and working capital requirements, but it was useful to make these reminders in order to refresh our ideas before moving on.

All of this leads us to profitability ratios. There are two main profitability ratios: financial profitability and the economic profitability.

Financial profitability is concerned with the return on equity, therefore, the profit generated by the company relative to what the shareholders contribute. Economic profitability, on the other hand, focuses on the overall profitability of the company, regardless of the method of financing, whether it comes from equity or a bank loan.

Return on Equity (ROE)

THE financial profitability ratio (ROE stands for Return On Equity) measures the profitability of the company compared to equity, that is to say in relation to to the funds provided by the shareholders in order to finance the company's assets. It allows us to know precisely the profit level depending on the amount of money invested by the shareholders.

The formula is as follows:

ROE = Net Income / Shareholders' Equity

If, for example, the net profit, which is found at the end of the income statement, is €50,000, and the shareholders' equity is €400,000, then the return on equity ratio is 50,000 / 400,000 = 0.125. The return on equity of this company is 12.5%, which means that €100 invested by shareholders generates an income of €12.50.

Return on Capital Employer (ROCE) Ratios

Unlike the financial return ratio, the economic return ratio (ROCE for Return on Capital Employed, or ROI for Return On Investment, which is a more generic term) focuses on the profitability of the activity of the company, all long-term resources confused, by reporting the income generated by the activity (therefore operating profit rather than net income) on all stable resources used to finance the asset.

Therefore, we base our decision on:

- on the operating profit (EBIT), and not the net result, in order to base it on the operational performance of the company, without taking into account financial and exceptional expenses in the calculation; ;

- and on all the company's stable resources, therefore both equity and long-term debt; ;

- And short-term debts are not taken into account (current operating liabilities and short-term financial debts are therefore excluded from the calculation).

Therefore, unlike the financial return ratio, which compared:

- the net result (which took into account in the calculation depreciation related to impairments, financial charges and exceptional charges); ;

- on equity (therefore excluding debts from the calculation); ;

The economic profitability ratio, on the other hand, is based on operating result (to exclude financial charges, exceptional items and profit tax) and on all the stable resources committed (equity and long-term debt).

Thus, ROCE makes it possible to exclude the company's financial structure, that is, the distribution of its financing (equity vs. debt), and to estimate profitability according to a global approach to wealth creation, while also focusing on the main activity of the company, since the calculation method excludes financial and exceptional charges (and includes depreciation and provisions depending on whether one bases on EBITDA or on REX).

THE ROCE does not take short-term debts into account in the calculation (such as supplier debts, tax and social debts, etc.) because these are not considered as capital employed: they fall under the operating cycle, therefore under short-term financing (related to working capital requirements).

First formula for the return on capital employed (ROCE) ratio

The first formula for the economic profitability ratio is as follows:

ROCE = EBITDA (or REX) / Stable resources

With Stable Resources = Equity + Long-term (LT) Financial Debt.

Note: short-term financial debts are excluded as they fall under the cash cycle.

For the calculation, one can base it either on the operating profit (EBIT) or on the gross operating profit (EBITDA). EBITDA is a more "raw" indicator than the operating profit: it excludes depreciation and provisions, while the operating profit includes them by deducting them from the calculation.

A brief digression on financial gymnastics

When we say that such and such an intermediate management balance or indicator excludes or includes certain expenses (such as depreciation or provisions), This simply means that these charges are or are not taken into account in the calculation of this indicator.

In concrete terms:

- If an indicator excludes a charge (meaning that the indicator does not take it into account), This means that This charge is not deducted from the calculation basis, and the indicator thus reflects the “raw” performance of the activity.

- If an indicator incorporates a load (meaning that it is taken into account in this indicator), This means that this charge is deducted, and the indicator thus reflects the “net impact” performance of this charge.

So from a purely logical point of view, excluding a charge does not mean subtracting it, but rather keeping it because it means that we do not take this charge into consideration as a charge to be subtracted for the calculation.

For example, EBITDA excludes depreciation and provisions, which means that these are not taken into account in the calculation of EBITDA, and this allows us to measure operational profitability before capital depreciation or observed risks; ; These charges are therefore not deducted..

The REX, on the other hand, incorporates these allocations, giving a result closer to the final accounting result of the operation. When we say that they are integrated, This means that they are deducted in order to to take them into account in the calculation.

This is a reminder that relates to the vocabulary used, but it was important to make it so as not to misunderstand things.

Second formula for the economic profitability ratio (ROCE bis)

The ROCE formula can also be calculated as follows, and this is very often the case in practice:

ROCE = REX or EBITDA / Economic Asset

With Economic Assets = Fixed Assets + Working Capital Requirement (WCR)

And economic assets ≈ stable resources (if net cash is zero)

This formula may seem confusing at first glance, but if we go back to the basics mentioned earlier related to the structure of a balance sheet, we realize that economic assets generally correspond to stable resources, provided that net cash is zero (FR = BFR).

Economic assets ≈ Stable resources (if net cash is zero)

Which brings us back to the first ROCE formula:

ROCE = REX or EBITDA / Stable resources

But then how do we go from stable resources to economic assets?

Definition of Economic Asset

Actually, Economic assets correspond to the sum of fixed assets, inventories, and accounts receivable (to simplify as much as possible), deduction made of circulating liabilities, that is to say supplier debts :

Economic assets = Fixed assets + Current assets – Operating liabilities

Indeed, beyond the formula, from a conceptual point of view, Economic assets correspond to all the resources necessary for the continuation of normal economic activity. of the company, therefore ultimately to its fixed assets (factory, machines, etc.), and to its operating cycle (current assets less supplier debts, to simplify).

In financial analysis, there are two ways to approach the structure of the balance sheet:

| Approach | Formula | Sense |

|---|---|---|

| Job approach (to the left of the functional assessment) | Economic assets = Fixed assets + Working capital | These are the sustainable jobs : what the company invested in its production tool and its operating cycle. |

| Resource approach (to the right of the functional assessment) | Invested capital = Equity + Net financial debt | These are the stable resources mobilized to finance these sustainable jobs. |

If we take the exact definition of Economic Asset, it is in fact the sum of fixed assets and working capital requirements (operating and non-operating products).

And since working capital requirement (WCR) = current assets – operating liabilities, everything makes sense here:

Economic assets = Fixed assets + Current assets – Operating liabilities = Fixed assets + Working capital

Therefore, from the moment the current liabilities are deducted from the calculation, we come and "remove" it from the liabilities. Therefore, only fixed assets and working capital (the result of subtracting current assets from current liabilities) remain on the asset side, and equity and long-term financial debt remain on the liability side. This gives us the following simplified functional balance sheet:

| Active (jobs) | Liabilities (resources) |

|---|---|

| Fixed asset | Equity |

| + Working capital requirement (current assets – operating liabilities) | + Long-term financial debt |

| + Cash assets (bank, cash) | + Liabilities cash (overdrafts, short-term loans) |

| = Economic asset | = Stable resources |

In the functional balance sheet, stable resources are solely permanent capital (equity + long-term debt).

Passive cash (overdrafts, short-term financial debts) is not a stable resource — it is part of net cash and compensates for a possible working capital deficit.

The equality Economic Assets = Stable Resources only holds if FR = BFR (net cash = 0).

Otherwise :

- FR > BFR → Positive net cash flow → Economic assets + surplus = Stable resources

- Working capital < working capital requirement → Negative net cash flow → Economic assets = Stable resources + overdraft

Theoretically, the current liabilities the accounting balance sheet includes all the debts due in less than one year, but in the functional assessment, we distinguish the operating debts (suppliers, tax, social), which are deducted from current assets to calculate working capital requirements, and liability cash (overdrafts, cash credits), which is classified in a separate liability cash item, at the bottom of the functional balance sheet.

Therefore, this last item does not belong to the functional current liability or to stable resources, because it participates in the overall balance FR − BFR = Net cash, and not in the operating cycle.

This is why, in calculating working capital requirements (WCR), we have repeatedly emphasized the exclusion of short-term financial debt. As a reminder:

Working capital requirement (WCR) = Current assets – Current liabilities (excluding short-term financial debts) = Current assets – Operating liabilities (Accounts payable, tax and social security liabilities, but not short-term financial debts).

Here's an animation to make it even clearer:

In this video, Economic Assets + Surplus = Stable Resources. I made this video to show how we can explain the equality between Stable Resources and Economic Assets:

- The working capital requirement (WCR) is calculated and recorded as an asset: the traditional current liabilities disappear from the functional liabilities, since they are included in the WCR calculation. Conversely, current assets disappear in favor of the WCR, which combines current assets minus current liabilities.

- And since the functional balance sheet is balanced, the stable resources (remaining on the liabilities side of the functional balance sheet) are equal to the fixed assets and the working capital requirement (which are therefore on the assets side of the balance sheet), and to the surplus of active cash.

- These stable resources (equity + long-term debt) finance fixed assets and working capital requirements, which both correspond to all the resources necessary for the continuation of the normal economic activity of the company: they therefore constitute the economic assets of the company.

In a functional assessment, Economic assets correspond to the sum of the uses necessary for the operation of the company. (fixed assets, stocks, accounts receivable, cash…), which are financed by stable resources (equity + long-term debt).

If stable resources are greater than fixed assets (or in other words, if FR > BFR), then there will be net cash on the asset side, corresponding to the surplus after full financing of the economic asset: this is exactly what can be seen in the video above.

On the other hand, if FR < BFR, there will be passive cash on the liabilities side (short-term financial debts), corresponding to the cash deficit.

In other words:

Stable resources – Economic assets = Net cash

Thus, at the bottom of the functional balance sheet, we will have net cash on the asset side if it is positive, or on the liability side in the form of bank overdraft if it is negative.

From a conceptual point of view, we can say that:

- Economic assets represent the jobs necessary for economic activity. (fixed assets + working capital requirement),

- while Stable resources represent the sustainable means of financing this activity (equity + long-term financial debt).

These two concepts therefore tend to merge when net cash flow is close to zero, hence the following approximation:

Economic assets ≈ Stable resources (if net cash is zero)

Is economic asset a useful approximation?

The "economic asset" approach (Fixed Assets + Working Capital Requirement) is intuitive for understanding what is actually invested in the business:

- It focuses on what is actually invested in the business (fixed assets + working capital requirements); ;

- It excludes purely financial elements (excess cash, financial investments, short-term debts) which do not belong to the operation; ;

- It allows us to directly compare economic performance (REX) with the cost of capital (WACC), which is the basis of value creation (we will discuss these concepts at the end of this course).

However, in France, the official formula remains:

ROCE = EBITDA / Stable Resources (Equity + Long-Term Debt)

The ROCE ≈ EBITDA / Economic Asset approximation is valid only if net cash ≈ 0

So to summarize:

- Stable resources finance economic assets, which consist of fixed assets and working capital requirements; ;

- This explains why the two formulas can be equivalent.

ROCE = EBITDA / Stable Resources

ROCE ≈ EBITDA / Economic Assets (valid only if net cash ≈ 0)

Because Stable Resources ≈ Economic Assets (if net cash ≈ 0)

| Approach | Formula | Context |

|---|---|---|

| Official (FR) | EBITDA / Stable Resources | Banks, DCG, accounting |

| Approximation | EBITDA / Economic Asset | Internal analysis, if cash ≈ 0 |

A reminder regarding cash assets and cash liabilities

It's important to briefly review current assets, current liabilities, and cash flow. We explained that:

ROCE = Rex / Economic Asset

With Economic assets = Fixed assets + Working capital

And Working capital requirement (WCR) = Current assets – Current liabilities

When we say that working capital requirement (WCR) = Current assets – Current liabilities, we are implicitly referring to operating current assets (mainly inventory and accounts receivable) and operating current liabilities (mainly accounts payable and tax and social security liabilities), but we do not include positive cash in current assets, nor short-term financial liabilities (bank overdrafts, for example) in current liabilities, because even if they relate to the short term, in a functional balance sheet, These are reclassified into separate categories, namely active treasury and passive treasury..

Therefore :

Working capital requirement (WCR) = Operating current assets (excluding cash) – Operating current liabilities (excluding short-term financial debt)

With :

- Operating current assets: inventories, accounts receivable, other short-term receivables, excluding cash and cash equivalents.

- Operating current liabilities: trade payables, other operating liabilities, excluding passive cash (short-term financial liabilities).

In this way, working capital requirements (WCR) allow us to measure the financial needs related to operations. It helps estimate the financing required to run the business: purchasing inventory, financing customers, and paying suppliers. Operating liabilities (suppliers, social security contributions, local taxes) reduce the short-term financing requirement (since these are debts that are repaid over time by nature), so they are logically subtracted from current assets.

Conversely, Short-term financial debts, such as overdrafts or short-term loans, are financial resources that are not linked to the operating cycle.. Including them would distort the measurement of the actual financing needs of the operating cycle, because working capital must show the capital required for the activity before external financing.

Simplified example:

| Element | Amount |

|---|---|

| Stocks | 100 |

| Accounts receivable | 150 |

| Supplier debts | 80 |

| Charges payable | 20 |

| CT bank overdraft | 50 |

WCR = (100+150) − (80+20) = 150

The working capital requirement (WCR) = 150 → actual need to finance operations.

If we included the bank overdraft of 50, the working capital requirement would then be equal to 100., which would give the false impression that the need is lower, whereas this financing made possible by the overdraft is in fact external to the operating cycle.

The purpose of this reminder was to raise awareness that in a functional assessment, Current assets, by their very nature, exclude cash. (which constitutes a distinct item at the bottom of the asset statement), and Current liabilities inherently exclude passive cash (which constitutes a distinct item at the bottom of the liabilities). This can be seen in the theoretical functional balance sheet table displayed at the beginning of this course.

Now that we have made this clarification, we will discover a third formula for economic profitability (ROIC) more commonly used internationally, which takes the opposite approach to what we have just said, by including short-term financial debts in the calculation method.

Indeed, in ROIC, these short-term debts (overdrafts, loans < 1 year) are considered as part of the capital actually used in the business — because they cost interest and finance operations.

Third formula for the economic return on investment (ROIC) ratio – international approach

Another, more international formula for economic profitability exists, and it is designated by the term Return On Invested Capital (ROIC):

ROIC = NOPAT / Invested Capital

With NOPAT = REX after theoretical tax (net operating profit after tax), which actually refers to the operating profit (EBIT) less theoretical tax This is the net "economic" profit the company would have if there were no debts (no interest), but taking taxes into account. We don't want to include interest because it's linked to debt, something we don't want to consider in an economic analysis. However, we must take into account "theoretical" taxes, which should be calculated based on operating income (EBIT) and not net profit, because we don't want to include tax reductions related to interest expenses, which are linked to the company's financial structure.

NOPAT = Operating profit after tax = Operating profit – (Operating profit x Tax)

And invested capital refers to the sum of equity and total financial debt (i.e., short-term and long-term financial debt), net of active cash (therefore reduced by excess cash, which is not actually used in operations):

Invested capital = Equity + Net financial debt = Economic assets

With Net Financial Debt = Total Financial Debt (Short and Long) – Cash and Cash Equivalents

The key difference here is that, unlike French ratios (ROCE), short-term financial debt is included (though not cash). This is because this short-term financial debt finances operations (e.g., overdrafts for working capital) and accrues interest: therefore, it is considered that... are part of the capital actually employed.

Thus, ROIC allows us to measure the profitability of resources committed to the activity, not financial investments or dormant reserves. In other words:

- We keep the “operational” cash, which can be considered as a resource; ;

- We remove excess cash, which does not contribute to the creation of operational value.

Cash and cash equivalents include available cash as well as excess liquid financial investments. Therefore, the latter is not taken into account, because Some practitioners consider that excess cash is not “used” in operations because it is not needed to finance the operating cycle or fixed assets; it does not contribute to generating operating profit and can be used freely for other investments or placements.

Conversely, passive cash flow is taken into account, therefore short-term financial debts, in the calculation method, unlike ROCE which only took into account stable resources, therefore long-term financial debts without short-term ones.

In summary, ROIC measures economic profitability by relating after-tax operating profit to invested capital. (that is: equity + total financial debt net of excess cash).

What is the "true" formula for economic profitability?

There is no true or false formula, the two are quite close but depending on the angle one wishes to approach and the practice, one will prefer the first or the third formula.

In banking, particularly in France, the first formula ROCE tends to be used, while in M&A (mergers and acquisitions sector), the third formula (ROIC) tends to be used.

| Context / Standard | Formula | Base of the denominator |

|---|---|---|

| Corporate Finance / M&A / CFA (International standards) |

ROIC = NOPAT / Invested capital | CP + Net debt (long-term + short-term) |

| Banks / Business plan (French standards – PCG, DCG/DSCG) |

ROCE = EBITDA or REX / Stable resources | CP + Gross long-term debt |

| French textbooks | The two coexist | Approximation if net cash ≈ 0 |

Cash ROIC

Another profitability ratio is Cash ROIC, which measures the cash profitability of the capital invested in operational activity. Highly regarded by investors (especially in value investing).

Cash ROIC = Free Cash Flow (FCF) / Invested Capital

With :

- Invested capital = Equity + Financial debt net of excess cash (short-term + long-term); ;

- Or, Invested capital = Economic assets = (Fixed assets + Working capital requirement); ;

- FCF = Operating cash flow – Maintenance investments (replacement CAPEX)

As for the invested capital, this should no longer be a mystery to you, as we discussed it earlier. It simply refers to the Equity and total financial debt (short and long term) net of excess cash, and that is equivalent to fixed assets plus working capital requirements (therefore, operating current assets – operating current liabilities, excluding short-term financial debts!) which together constitute the economic asset.

Note that with regard to invested capital, it is important to include all financial debt in the "Resources" approach, and to exclude short-term financial debt in the "Uses" approach.

| Notion | Correct formula | Details |

|---|---|---|

| BFR | Operating current assets – Operating current liabilities | Excludes CT financial debts |

| Economic asset | Fixed assets + Working capital | Represents the use of productive resources |

| Invested capital | Equity + Net financial debt (short-term + long-term – excess cash on the balance sheet) | Represents sustainable financial resources |

| Equality is key | Economic assets = Invested capital | Both sides measure net productive capital |

Thus, consistency is maintained between invested capital and economic assets:

Invested capital = Fixed assets + Working capital

FCF are in fact the available cash flow, These metrics measure a company's ability to generate cash flow after covering operating expenses and investments. This cash is available to be distributed to shareholders, used to repay debts, or invested in new opportunities.

Free cash flows (FCF) are derived from the cash flow statement (CFS), which details the flows related to operating, investing, and financing activities. To avoid making this course too long and complex, we will cover FCF and the cash flow statement in a dedicated section, but the important point here is simply to understand that...Cash ROIC allows us to measure profitability in terms of cash flow by comparing available cash flows. (so the money that remains after covering operating expenses and maintenance investments such as replacing a machine, for example) on invested capital (so simply equity + net financial debt, which corresponds to the amount of capital actually “locked up” in productive activity).

As a reminder, net financial debt is all debt that costs interest (LT + CT) less immediately available cash (cash + short-term investments).

In summary, Cash ROIC seeks to measure the cash return on capital actually invested in productive activity.

Link between Profitability and Leverage

We had seen in the chapter devoted to Leverage, that the latter allowed to express the impact of resorting to debt (capital from third parties) on the return on equity, compared to a financing primarily through equity.

And as we saw in this same chapter, financial profitability is not limited to a simple calculation of net income relative to equity: It is also influenced by the company's debt., depending on economic profitability, through what is known as financial leverage.

This leverage effect has a direct influence on financial profitability, as it explains the relationship between:

- Economic profitability (asset performance independent of financing)

- And financial profitability (performance for shareholders)

Indeed, financial profitability will be influenced by debt:

- If the economic return exceeds the average cost of debt, then borrowing increases the financial return (positive leverage effect). The borrowed funds generate more than their cost.

- If the economic return is lower than the cost of debt, the debt reduces the financial return (negative leverage effect). The debt costs more than the return on the investments made possible by that debt.

In summary:

| Situation | Impact on financial profitability |

|---|---|

| Economic profitability > cost of debt | Positive leverage → financial profitability increases |

| Economic profitability < cost of debt | Negative leverage → financial profitability decreases |

Furthermore, when the return on capital employed (ROCE) is greater than the average cost of debt (i), the return on equity (ROE) necessarily becomes greater than the return on capital employed, as long as the company is indebted.

Indeed, borrowed capital then yields more than it costs, thus increasing the return on equity: this is the positive leverage effect. Conversely, if the economic return falls below the cost of debt, the financial return drops below the economic return, reflecting a negative leverage effect.

Note that it is not the fact that ROE is greater than ROCE that causes leverage, but rather the fact that ROCE is greater than the cost of debt (i) that explains why ROE becomes greater than ROCE. The comparison between ROE and ROCE is a consequence of leverage (not the cause), while the comparison between ROCE and i is the cause.

A concrete example of calculating financial profitability and leverage

Let's imagine a company that has the following characteristics:

- Equity: €400,000

- Long-term debt: €100,000 at a rate of 5%.

- Operating profit: €50,000

There are two simple ways to view leverage: the pre-tax version (often used in France), and the more "rigorous" after-tax version (international standard).

Pre-tax version

Step 1 – Calculating the cost of debt:

Debt interest = i = 100,000 x 0.05 = €5,000

Step 2 – Current profit before tax:

RN = REX – i = 50,000 – 5,000 = €45,000

Step 3 – Economic Profitability

ROCE = REX / Stable Resources = REX / Equity + Long-Term Debt = 50,000 / 500,000 = 10%

Step 4 – Financial profitability:

ROE = Net Income / Shareholders' Equity = 45,000 / 400,000 = 11.25%

In this example, the financial return (11.25 %) is higher than the initial economic return on assets (10 %), and this is explained by the fact that the economic return of 10% is higher than the cost of debt (5 %). Therefore, the debt has had a positive leverage effect.

After-tax version

Step 1 – Calculating the cost of debt:

Debt interest = i = 100,000 x 0.05 = €5,000

Cost of debt after tax = 5,000 × (1 − 0.25) = €3,750

Here, since we are working on an after-tax version, we calculate the cost of the debt with a tax deduction of 25%.

Indeed, since interest payments are tax-deductible, the actual cost of the debt to the company is therefore lower than the gross interest rate. The following formula is applied: Cost after tax = ix (1 – corporate tax rate)

Here: 5 % × (1 − 0.25) = 3.75 % → it is this cost that counts in the real leverage effect.

Step 2 – After-tax result

Current profit before tax = 50,000 − 5,000 = 45,000

Corporate tax = 45,000 × 25 % = 11,250

Net result = 45,000 − 11,250 = €33,750

Step 3 – Economic Profitability

ROIC = NOPAT / Invested Capital = (Operating Profit – (Operating Profit x Tax)) / (Equity + Net Financial Debt) = (50,000 – (50,000 x 0.25)) / (400,000 + 100,000) = 7.5%

The ROIC is logically lower than the ROCE because we have taken into account an operating profit after tax (NOPAT). Note that in our example, we have not entered any available cash, but if there had been any, it would have had to be deducted in the denominator.

Step 4 – Financial Profitability

ROE = Net Income / Shareholders' Equity = 33,750 / 400,000 = 8.44%

Interpretation of the example

- In the first case, ROCE = 10 %: it is greater than the cost of debt before tax (5 %) → the leverage effect is theoretically positive.

- In the first case, ROE = 11.25%: financial profitability is slightly higher than the ROCE of 10% → debt has created value for the shareholder.

- In the second case, ROIC = 7.5 %: it is still higher than the cost of debt even after tax (3.75 %) → the leverage effect is actually positive, but small.

- In the second case, ROE = 8.44 %: financial profitability is slightly higher than the ROIC of 7.5 % → debt has indeed created value for the shareholder.

- Conclusion: The leverage effect is positive but moderate (low debt: D/CP = 25 %).

To further analyze a company's financial situation, there are other very useful ratios that allow us to measure profitability at different levels.

Gross margin (or trade margin)

Gross margin allows us to measure the company's performance before operating expenses. It therefore measures the "weight" that the cost of purchasing goods sold represents on the turnover.

Gross margin = (Revenue – Cost of goods sold) / Revenue × 100

A high gross margin means that the company has good control over its direct costs. For a service company (consulting, IT, marketing, training, etc.), this formula is meaningless, and to calculate the gross margin in this specific context, we replace the cost of goods with the direct production costs of the service, that is, the costs directly allocated to delivering the service, which are primarily the salaries and social security contributions of the employees who provide the service (and who are therefore the "productive" assets). And in this case, the formula becomes:

Gross margin = (Revenue – Direct production costs) / Revenue x 100

With direct production costs = Gross salaries + social security contributions + various expenses for travel, subcontracting, etc…

Net margin

It translates the final profit after paying all the company's expenses, by calculating the ratio of net income to revenue.

Net margin = Net income / Revenue x 100

ROA (Return on Assets) – Profitability of assets

ROA measures the overall efficiency of the company by generate net profit from all of its assets (financed by debt and equity).

ROA = Net Income / Total Assets

There is a operational variant sometimes considered more robust:

Operating ROA = Operating Profit (EBIT) / Total Assets

ROA is an indicator that helps answer the following question: How much net profit does the company generate per euro of total assets?, regardless of the financial structure, This is ideal for comparing companies of different sizes, or that do not belong to the same sector, and therefore have very different financing structures.

Indeed, ROA neutralizes size and sector by measuring asset efficiency as a percentage, independently of financing or operational specifics.

Note: Distinction between ROA and economic profitability

Some authors use the term "economic profitability" to refer to operating profit divided by economic assets (often excluding cash and financial debt). ROA, on the other hand, generally takes net income into account and relates to total assets.

In practice, the two ratios are very close, but it is important to keep in mind that ROA includes the effect of the financial and tax structure, while economic profitability is limited to the operational performance of the assets.

Link between ROA, ROE and Financial Leverage

ROE (financial profitability) measures profitability for shareholders, while ROA (economic profitability) measures the profitability of all the company's assets, regardless of financing.

These two indicators are linked by the financial leverage effect, which reflects the influence of debt on the profitability of equity.

As a reminder, ROE is the financial profitability ratio, the formula for which is:

ROE = Net Income / Shareholders' Equity

This indicator therefore measures the return on equity. One mathematical method for linking several indicators together consists of decomposing the ratios into interpretable sub-elements and multiplying by a fraction equal to 1.

Thus, when one wishes to "link" ROE (which measures profitability on equity) to ROA (which measures profitability on total assets), it suffices to multiply ROE by the denominator of ROA, which is precisely the total assets, in the form of a neutral fraction:

ROE = (Net Income / Equity) x (Total Assets / Total Assets) = (Net Income / Total Assets) x (Total Assets / Equity) = ROA x (Total Assets / Equity).

SO ROE = ROA x (Total Assets / Equity)

Now, from a purely logical point of view, knowing that Total Assets = Equity + Debts, the more debt the company has, the more the equity located alone in the denominator will be "low" in proportion, therefore the Total Assets / Equity ratio will be high (and vice versa).

Therefore, the value derived from the ratio between Total Assets and Equity increases as the company takes on debt, and since this value is multiplied by the ROA (which is ultimately one of the economic profitability ratios), then the ROE (the return on equity ratio) increases as the ROA increases thanks to the Total Assets / Equity ratio, a ratio that we can describe as financial leverage:

ROE (Return on Equity) = ROA x Financial Leverage

With financial leverage = Total assets / Equity

This formula shows that The more indebted the company is (therefore, the higher the Assets/Equity ratio), The more financial profitability is mechanically amplified, provided that the economic return on assets exceeds the cost of debt. This refers to structural financial leverage : it shows how the financing structure affects profitability.

When discussing whether economic profitability exceeds the cost of debt, it's important to clarify that this formula says nothing about whether leverage is beneficial or destructive. It only shows the potential for amplification linked to debt. To understand whether debt improves or deteriorates profitability, we need to introduce the cost of debt (i):

ROE = ROA + (ROA – i) * Debt / Equity

Remember, we saw this formula in a slightly different form in the chapter on leverage :

ROE = Economic profitability + (Economic profitability – Cost of debt) × Financial debt / Equity

- If ROA > i, then the term (ROA – i) is positive, and debt amplifies profitability for shareholders.

- If ROA < i, then the term is negative, and debt reduces financial profitability.

- If ROA = i, the effect is neutral: debt does not change ROE.

But be careful, it is important to clarify that what has been done here is a pedagogical simplification to understand the mechanical idea of leverage: the more assets are financed by debt, the more the return on equity is “amplified”; it is also a valid approximation if we assume that there are no interest or taxes, therefore in an “ideal” world with no financing costs.

But in real life, for management or business analysis, we will inevitably use return on capital employed (ROCE), and we will link this return on investment to return on equity (ROE). via the full leverage formula.

In summary:

| Formula | Utility | Assumption |

|---|---|---|

| ROE = ROA × (A / CP) | Approach educational and simplified | No costly debts (or i = 0) |

| ROE = ROCE + (ROCE – i) × (D / CP) | Approach realistic and financial | Includes the cost of debt |

| ROE = Net Income / Shareholders' Equity | Ratio final accountant | Includes all effects (financing, taxation, etc.) |

ROA and Asset Turnover

Finally, ROA is an indicator of asset productivity: it helps identify whether low profitability stems from a low margin or poor asset utilization, using the following formula:

ROA = Net Margin × Asset Turnover

With Asset Turnover = Revenue / Total Assets

Before explaining this formula, it is important to clarify that this formula comes from the following:

ROA = (Net Income / Revenue) x (Revenue / Total Assets)

And to arrive at this, just as in the previous point, we went from the initial ROA formula to this one, by multiplying the initial ROA formula by the CA via a neutral fraction, therefore:

ROA = Net Income / Total Assets = (Net Income / Total Assets) x (Revenue / Revenue) = (Net Income / Revenue) x (Revenue / Total Assets)

Which gives us:

ROA = (Net Income / Revenue) x (Revenue / Total Assets)

But what is the relationship between this formula and asset turnover (or productivity)? Why was revenue included in the calculation, and what does asset turnover measure? Why is it equal to revenue / total assets?

Actually :

- Net result / Revenue = net margin (how much the company keeps as profit for 1 € of revenue).

- Revenue / Total Assets = Asset Turnover (how much revenue is generated per €1 of assets).

So, ROA depends on both commercial profitability (margin) and economic efficiency (asset turnover).. That's why we say:

ROA = Net Margin × Asset Turnover

And this is where ROA allows us to identify the source of profitability for an asset, between the margin generated by sales revenue and the revenue share of total assets—ultimately, the productivity of the assets, or simply put, their profitability. Although here, we're talking more about asset "turnover," as this reflects the speed at which assets are "working" to generate revenue. High turnover means the company is efficiently utilizing its resources; low turnover indicates underutilized assets.

Example of ROA, ROE and Financial Leverage

Example 1: Structural leverage effect (without debt cost)

Let's take the formula ROE = ROA × (Total Assets / Equity) which does not take into account the cost of debt, and which simply shows the mechanical effect of debt: the lower the equity is compared to the total assets, the more the return on this equity is amplified.

Example :

- Net result = €100,000

- Total assets = €1,000,000

- Equity = €500,000

Here's how to calculate financial debt, ROA, financial leverage, and ROE:

- Financial debt = Total liabilities – Equity = 1,000,000 – 500,000 = €500,000

- ROA = Net Income / Total Assets = 100,000 / 1,000,000 = 10 %

- Financial leverage = Total assets / Shareholders' equity = 1,000,000 / 500,000 = 2

- Therefore, ROE = ROA x Financial Leverage = 10 % × 2 = 20 %

Here, we assume that the cost of debt is zero (or already included without impact), simply to illustrate the multiplier effect of leverage. The company doubles its financial profitability thanks to debt: it earns 20 % on its equity instead of 10 % if it were not indebted.

This example provides a theoretical illustration of the impact of debt on shareholder profitability, as we explained earlier in the theoretical section. However, in practice, debt comes at a cost: the interest rate. This leads us to the next two examples.

Example 2 — Positive leverage effect (economic return > cost of debt)

Data :

- Economic assets: €1,000,000

- Equity: €500,000

- Financial debts: €500,000

- Operating profit: €100,000

- Debt interest rate: 5.%

Calculations:

- Net result = 100,000 – (5 % × 500,000) = 100,000 – 25,000 = €75,000

- ROCE = 100,000 / 1,000,000 = 10 %

- ROE = 75,000 / 500,000 = 15 %

Explanation :

The economic return (10 %) is greater than the cost of debt (5 %), so leverage has a positive effect. The company improves its return for shareholders: 15 % instead of 10 % without debt. Here, we used the ROCE formula as well as the full leverage formula, because we had to include the cost of debt in the calculation. We did not consider income tax to simplify the example as much as possible.

Example 3 — Negative leverage effect (economic return < cost of debt)

Data :

- Economic assets: €1,000,000

- Equity: €500,000

- Financial debts: €500,000

- Operating profit: €30,000

- Debt interest rate: 5.%

Calculations:

- Net result = 30,000 – (5 % × 500,000) = 30,000 – 25,000 = €5,000

- ROA = 30,000 / 1,000,000 = 3 %

- ROE = 5,000 / 500,000 = 1 %

The economic return (3 %) is lower than the cost of debt (5 %), therefore leverage has a negative effect. Debt reduces the return on equity.

In summary:

| Situation | ROA | Cost of debt | ROE | Leverage effect |

|---|---|---|---|---|

| Example 1 | 10 % | 0 % | 20 % | Pure mechanics of the lever |

| Example 2 | 10 % | 5 % | 15 % | Lever positive |

| Example 3 | 3 % | 5 % | 1 % | Lever negative |

Operating margin

The operating margin (ROS for Return on Sales) shows the profitability generated solely by the company's activity, without taking into account financing or exceptional items.

This ratio measures a company's ability to generate operating profit from its revenue. It's an operating margin indicator. Simply put, it's operating profit divided by revenue.

Operating margin (ROS) = REX / CA

Link with ROA:

We previously stated that ROA = Net Margin x Asset Turnover, and that ROA therefore measures the profitability of the asset, based on overall profitability (here the net margin) and the "speed at which the asset is profitable", here the asset turnover, the formula for which is Revenue over Total Assets.

We can link the operating margin (ROS) to the ROA by calculating an "operating" ROA, since it is linked to the operating margin, by simply replacing the net margin with the operating margin in the calculation formula:

Operating ROA = Operating Margin x Asset Turnover = (EBIT / Revenue) x (Revenue / Total Assets) = EBIT / Total Assets

Here, we simply replaced the net margin with the operating margin (ROS) to obtain an operating ROA.

So instead of having ROA = Net Income / Total Assets, we have operating ROA = Operating Income / Total Assets. This gives us a more "operational" ROA, which excludes interest expenses and taxes from the margin, and which measures the economic performance of assets, always independently of the financing method.

DuPont Formula – ROE Decomposition

The DuPont formula (or DuPont de Nemours analysis) is a classic financial analysis tool that allows financial profitability (ROE) to be broken down into several explanatory levers.

It shows where return on equity comes from, and what levers a company can use to improve it.

This formula is based on financial profitability, as a reminder:

ROE = Net Income / Shareholders' Equity

This ratio, taken in isolation, indicates how much the company earned for every €1 invested by shareholders. But it says nothing about the source of this profitability: does it come from a good margin, a high turnover of its assets, or simply from the leverage effect linked to debt?

This is where the DuPont method comes in. From a pedagogical point of view, it can be formulated in two ways: conceptually (in order to intuitively understand the interest of the formula) and purely mathematically.

Conceptual decomposition

Step 1: Link ROE to economic profitability (ROA) and financial leverage

To do this, we return to the formula we discovered earlier, which links ROE to ROA and financial leverage:

ROE = (Net Income / Equity) x (Total Assets / Total Assets) = (Net Income / Total Assets) x (Total Assets / Equity) = ROA x (Total Assets / Equity)

Two ratios are clearly visible here:

- Net income / Total assets = ROA → economic profitability (or return on assets)

- Total assets / Equity → financial leverage (debt measure)

ROE = ROA x Financial Leverage

This means: financial profitability depends on economic profitability and the financing structure (leverage).

Step 2: Decompose ROA into its two components: net margin and asset turnover

ROA (net income / total assets) can itself be broken down:

ROA = Net Income / Total Assets = (Net Income / Revenue) x (Revenue / Total Assets)

In this formula:

- Net income / Revenue = Net margin

- Revenue / Total Assets = Asset Turnover

Therefore, ROA = Net Margin × Asset Turnover

This means: economic profitability comes from the ability to make margins and to use one's assets well.

Step 3: Link the two and form the final DuPont formula

To arrive at DuPont's final formula, it is therefore sufficient to substitute the ROA from step 1 with its decomposition seen in step 2:

ROE = ROA x (Total Assets / Equity) = (Net Income / Revenue) x (Revenue / Total Assets) x (Total Assets / Equity)

Therefore, ROE = Net Margin x Asset Turnover x Financial Leverage

In summary:

- ROE depends on ROA and financial leverage: ROE = ROA x Financial Leverage

- ROA depends on net margin and asset turnover: ROA = Margin x Asset Turnover

- Combining the two: ROE = Margin x Asset Turnover x Financial Leverage.

In short, DuPont highlights the three levers of financial profitability:

| Element | Formula | Interpretation |

|---|---|---|

| Net margin | Net income / Revenue | Ability to generate profit on revenue |

| Asset rotation | Revenue / Total Assets | Efficiency in resource use |

| Financial leverage | Total Assets / Equity | The effect of debt on profitability |

Thus, a company can improve its ROE:

- either by increasing its margin (better commercial profitability),

- either by accelerating the turnover of its assets (more revenue for the same capital),

- either by using financial leverage (financing more through debt).

Mathematical decomposition

Here's how to do it.

a) First, we introduce the neutral fraction CA / CA:

ROE = (Net Income / Shareholders' Equity) x (Revenue / Revenue) = (Net Income / Revenue) x (Revenue / Shareholders' Equity)

b) Next, we introduce the neutral fraction of total assets:

ROE = (Net Income / Revenue) x (Revenue / Equity) x (Total Assets / Total Assets) = (Net Income / Revenue) x (Revenue / Total Assets) x (Total Assets / Equity)

Therefore, ROE = (Net Income / Revenue) x (Revenue / Total Assets) x (Total Assets / Equity)

And what do we notice? That ROE is equal to net margin x asset turnover x financial leverage.

ROE = Net margin × Asset turnover × Financial leverage

Each term corresponds to a distinct performance lever:

| Element | Formula | Interpretation |

|---|---|---|

| Net margin | Net income / Revenue | Measures commercial profitability (sales profitability) |

| Asset rotation | Revenue / Total Assets | Measures economic efficiency (resource utilization) |

| Financial leverage | Total Assets / Equity | Measures the intensity of indebtedness (financial structure) |

Put another way: ROE = Commercial profitability × Economic efficiency × Financial structure.

The strength of the DuPont method lies in going beyond a simple figure. It allows for the precise identification of the source of a variation in ROE:

- If the ROE is decreasing, is it due to a lower margin?

- Or a slower asset turnover?

- Or perhaps reduced debt?

👉 In other words, it transforms an overall ratio into a diagnostic and management tool.

Simplified example of the DuPont method

Let's consider a company with the following data:

- Net result: €50,000

- Revenue: €1,000,000

- Total assets: €500,000

- Equity: €250,000

Calculations:

- Net margin = 50,000 / 1,000,000 = 5 %

- Asset turnover = 1,000,000 / 500,000 = 2

- Financial leverage = 500,000 / 250,000 = 2

- ROE = 5% × 2 × 2 = 20%

➡️ The company therefore generates 20 % of return on its equity, thanks to:

- a reasonable profit margin (5 %),

- efficient use of its assets (rotation = 2),

- and a positive financial leverage (2).

Strategic reading

| If… | SO… | Interpretation |

|---|---|---|

| The net margin increases | ROE ↑ | Better business profitability |

| Asset turnover increases | ROE ↑ | Assets better utilized |

| Financial leverage increases | ROE ↑ (if ROA > cost of debt) | Positive leverage |

| Financial leverage increases | ROE ↓ (if ROA < cost of debt) | Destructive leverage |

In summary, the DuPont method shows that financial profitability is the result of three key dimensions:

- commercial performance,

- economic performance,

- and the financing structure.

This is a fundamental formula in financial analysis, as it links operational, economic and financial performance in a single coherent and intuitive reading.

What is the difference between ROCE and ROA?

In fact, ROCE allows us to determine if the company is profitable (regardless of funding sources) at the operational level, via EBITDA or operating profit, relative to stable resources. It's a first line of operational analysis.

ROA complements the analysis by estimating the overall profitability (i.e., net income) across all assets (including all company expenses, not just operating costs). This provides a more comprehensive framework, and, crucially, comparing the two indicators allows us to draw conclusions about the impact of debt on the project's profitability.

| Criteria | ROCE | ROA |

|---|---|---|

| Numerator | EBITDA or EBIT (before interest/taxes) | Net result (after all) |

| Denominator | Stable resources (Equity + Long-Term Debt) | Total assets |

| Vision | Operational (pure activity) | Total (includes financing + taxes) |

| Utility | Evaluate the profitability of the activity | Measures the productivity of assets |

For example, a significantly higher ROCE (10%) than ROA (4%) essentially tells us that the operating activity is profitable relative to financing, but that financial expenses (interest) and taxes significantly reduce net income, suggesting debt that is weighing on net profitability. The core business is therefore healthy a priori, but in this case, it would be interesting to know what justifies this debt and how long it will last.

Visual summary – Hierarchy of ratios

| Level | Ratio | Formula | Measure |

|---|---|---|---|

| Sales | ROS | REX / CA | Operating margin |

| Assets | ROA | Net Income / Total Assets | Overall productivity |

| Capital | ROCE / ROIC | EBE or NOPAT / Resources | operational profitability |

| Shareholders | ROE | RN / CP | Final profitability |

| Cash | Cash ROIC | FCF / Invested Capital | Cash creation |

Key points to remember regarding the different ratios

- ROS = how we win

- ROA = what we win with

- ROCE/ROIC = how much it costs

- ROE = who benefits

- DuPont = why

How to interpret economic and financial profitability ratios?

There are several ways to interpret profitability ratios. For example:

- to compare economic profitability (ROCE) and financial profitability (ROE) in order to determine whether the company benefits from a positive leverage effect or not; ;

- to analyze the evolution of these ratios from one year to the next; ;

- to compare the company's profitability rates with those of the industry sector.

Profitability levels vary greatly across sectors. As an indication, economic profitability is generally between 8 and 15 in services, 4 to 8 in industry, 3 to 8 in retail and 4 to 6 in construction.

Economic profitability can be improved, as we saw in the DuPont formula, through several avenues.

Improve operating margin (numerator ↑)

- Increase in revenue:

- better commercial and marketing policy; ;

- diversification of higher margin products/services; ;

- development of new markets (export, digital, B2B, etc.).

- Reduction of operating costs:

- productivity gains; ;

- automation or digitalization of processes; ;

- reduction of fixed costs (subcontracting, outsourcing, renegotiation of contracts); ;

- better control of personnel costs and purchases.

Optimize asset turnover (denominator ↓)

- Reduction of working capital requirements (WCR):

- shorten customer payment times; ;

- extend supplier lead times (without damaging relationships); ;

- reduce stocks (just-in-time, better demand forecasting).

- Improving the use of fixed assets:

- improved preventive maintenance and equipment management; ;

- sale or lease of underutilized assets; ;

- using rental or leasing to avoid tying up capital.

Strategic trade-offs

- Refocus the activity on the most profitable businesses or products; ;

- Close down or sell off activities with low economic profitability; ;

- Investing in technologies or equipment that are more energy-efficient or productive; ;

- Review the organizational structure to reduce costs and streamline decision-making.

Economic profitability can therefore be improved by increasing the operating margin (increased turnover, cost control, productivity gains, etc.), by optimizing asset turnover (reduction of working capital requirements, better use of fixed assets, disposal of underutilized assets, etc.), and by making strategic trade-offs to concentrate resources on the most profitable activities.

Finally, financial profitability can be increased if the company takes advantage of debt that generates a positive leverage effect, that is, when economic profitability is greater than the cost of debt.

Link with value creation and the cost of capital

All the concepts discussed here relating to profitability lead us to the core of corporate finance: value creation. A company only creates value when it if she earns more than her capital costs her. And for that, the The company's economic profitability must be greater than the weighted average cost of capital. (WACC stands for Weighted Average Cost of Capital), that is to say what capital ultimately costs. If it is lower, the company destroys value.

When a company invests, it mobilizes financial resources coming from its shareholders (equity) and its lenders (debts). These resources have a cost : THE shareholders expect a return in the form of dividends or capital gains, and the lenders collect interest.

THE Weighted average cost of capital (WACC) therefore represents the overall cost of capital mobilized to finance the company. He translates the minimum profitability required by those who provide funds.

Value creation occurs when the return on capital employed (ROCE) exceeds the cost of capital. In other words, a company creates wealth if each euro invested generates more revenue than it costs to finance. Otherwise, it destroys value, even if it remains profitable on the surface.

This logic, at the heart of modern corporate finance, underpins investment, financing, and strategic management decisions. And there are methods and calculations for estimating this WACC. We will see this in the next chapter of This course, dedicated to corporate finance, has a table of contents that you can find here. !

Solved exercises

Exercise 1 – Economic profitability of an industrial SME

The company MecaPlus, specializing in the manufacture of metal parts, wishes to analyze its operational performance for year N.

Here are the financial details:

| Elements | Amounts (in €) |

|---|---|

| Turnover | 4 800 000 |

| Operating result | 420 000 |

| Economic assets (fixed assets + working capital) | 3 200 000 |

Questions

1. Calculate the economic profitability (EP) of MecaPlus.

%

Correction: RE = 420,000 / 3,200,000 = 13,1 %

2. Interpret this result: does the operational performance seem satisfactory to you in relation to a sector whose average is 10 %?

Correction: Profitability is higher than that of the sector; the company therefore creates above-average operational performance.

To go further

3. What operational lever could further improve economic profitability (productivity, price, cost structure…)?

Correction: Improving productivity, moving upmarket (price) or reducing fixed/variable costs are relevant avenues to explore.

Exercise 2 – Financial leverage and return on equity

The company Consultia, a strategy consulting firm, wants to compare its financial profitability to its economic profitability.

| Elements | Amounts (in €) |

|---|---|

| Net result | 300 000 |

| Equity | 1 500 000 |

| Economic profitability (EV) | 12 % |

| Average cost of debt (after taxes) | 4 % |

| Financial debts | 800 000 |

Questions

1. Calculate the financial return (FR) for shareholders.

%

Correction: RF = 300,000 / 1,500,000 = 20 %.

2. Compare RF and RE: is the financial leverage effect positive or negative?

Correction: RF (20 %) is greater than RE (12 %) while the debt only costs 4 %. The leverage effect is therefore positive.

To go further

3. In what circumstances would leverage become unfavorable?

Correction: The leverage effect would reverse if economic profitability fell below the cost of debt.

Exercise 3 – Comparing the profitability of two activities

The company FoodLog, a specialist in food logistics, develops two activities:

- Activity A cold storage

- Activity B urban delivery

The following information is available for year N:

| Elements | Activity A | Activity B |

|---|---|---|

| Turnover | 6 000 000 € | 3 200 000 € |

| Operating result | 480 000 € | 250 000 € |

| Economic assets | 4 800 000 € | 1 600 000 € |

Questions

1. Calculate the economic profitability of activity A.

%

Correction: RE(A) = 480,000 / 4,800,000 = 10 %.

2. Calculate the economic profitability of activity B.

%

Correction: RE(B) = 250,000 / 1,600,000 = 15,6 %.

3. Which activity is the most operationally efficient? Justify your answer.

Correction: Activity B has a higher profitability; it generates more profit per euro invested.

To go further

4. If the company were to prioritize its investments, what would you suggest in light of the observed returns?

Correction: Investments should primarily target activity B, which optimizes the capital invested more effectively.

👉 Next chapter: coming soon.

📖 Back to Table of Contents