Welcome to this masterclass dedicated to the business management ! If you are an entrepreneur, craftsman, solopreneur, infopreneur, freelancer, or manager of a small business/SME, this course is designed for you. It is a long, incremental, and dynamic program, which will grow chapter by chapter over time. We will start from the simplest basics and move towards the complex, with digestible, didactic explanations, and bridges between disciplines to form a "new discipline": holistic business management and steering for business leaders, managers and entrepreneursThe goal? To transform you into a Swiss Army knife capable of managing a business day to day, evaluating a company, monitoring the competition, and negotiating bank loans.

This content is part of the course “Business Management for Entrepreneurs: A Complete Course to Better Manage Your Business” find it on Tulipemedia.com 💰📈

This chapter zero is a general introduction and summary of this guide. It lays the foundation and explains why investing time in these subjects can change the trajectory of your career. Take 20-30 minutes to read it, and feel free to comment your thoughts at the bottom of the page—your feedback will help me refine the following chapters!

Business Management Course Summary

Future :

🔢 CHAPTER 6 – Net Cash Flow and Cash Management

- Definition of net cash (Cash = FR – WCR)

- Difference between profit and cash flow

- The causes of a mismatch between profits and cash

- Diagram of cash flow evolution in the operating cycle

- Cash flow management tools (cash flow plan, budget, etc.)

- Concrete cases and exercises

📊 CHAPTER 7 – The main financial ratios to know

Do you have a business and want to regain control of your margins and your business model? Discover my solution Ultimate Business Dashboard which transforms your raw accounting data into performance indicators and a monthly dashboard.

- Structural ratios (financial autonomy, debt)

- Profitability ratios (margin, ROE, ROA, etc.)

- Turnover ratios (stocks, customers, suppliers, etc.)

- Interpretation of ratios and warnings

- Summary tables + Quizzes/exercises

💸 CHAPTER 8 – The Break-Even Point and the Break-Even Point

- Fixed/variable costs

- Margin on variable cost

- Calculation of the break-even point (BTP) and the break-even point

- How to interpret these indicators

- Strategies to improve profitability

- Application to an income statement

🧮 CHAPTER 9 – Profitability and Margin Analysis

- Gross margin / net margin / EBITDA / EBIT

- Margin rate / markup rate

- Impact of operating leverage

- Inter-company comparison

- Case studies

💰 CHAPTER 10 – The Cash Flow Statement

- Why the result does not reflect cash flow

- Presentation of the 3 main categories: activity, investment, financing

- Calculation of operating cash flow (CAF)

- Reading and interpretation

- Spreadsheet exercise

⚖️ CHAPTER 11 – Company financing: equity, debt, etc.

- Sources of financing: equity, debt, leasing, grants

- Advantages/disadvantages of each source

- Cost of capital (WACC)

- Debt ratios

- Financing strategies according to the company's life stage

🧠 CHAPTER 12 – Global Financial Analysis

- Analysis methodology: balance sheet + result + ratios approach

- Simple financial diagnosis: solvency, profitability, financial balance

- Scenario: analyze a fictitious company

- Standard summary sheet + downloadable model

📁 CHAPTER 13 – Financial business plan and forecasts

- How to build a simple financial forecast

- Key assumptions (volume, price, costs)

- Tools (Excel spreadsheets, SaaS solutions)

- Examples of complete forecasts

- What investors or bankers are looking for

🧩 CHAPTER 14 – Common Mistakes in Financial Management

- Overinterpretation of accounting results

- Confusion between turnover and profitability

- Poor management of working capital

- Underestimation of financing needs

Introduction: Confession of a “Repentant” Entrepreneur

Let me tell you a personal story, drawn from my experience as a restaurant business owner and a digital solopreneur. For years, I was navigating by sight. I focused on revenue development, marketing, and day-to-day operations. Accounting? I outsourced it to an accountant, as if it were a boring legal requirement. Corporate finance? Something for large corporations. Management control? A vague memory from college.

The result? After several years, I discovered that my business model was fundamentally flawed: prices too low, unclear positioning, high expenses, accumulated accounting losses, and debt that led my company into a perilous financial situation.

I had wasted time and money. Worse, each year, it was only after a year and a half of activity – when the annual review was being prepared – that the reality hit me, without me finding any solutions either. If I had trained myself from the start, I could have formalized my model (pricing, positioning, marketing) to quickly test profitability, pivot if necessary, or scale with complete peace of mind.

And you? Have you ever had that feeling of "chasing turnover" without knowing if you're really making money? It's common among entrepreneurs: we boost sales, but we ignore the real profitability, the break-even point, or the hidden costs, and we only manage based on a single indicator: the cash available in the bank, which can lead to disasters.

Hence the interest of this course: to be equipped from the start to avoid these pitfalls. For example, I recently understood the importance of classifying invoices on a daily basis. With the right tool, in this case my financial management solution Business Dashboard Pro, this generates a monthly dashboard – like a simplified income statement – that immediately shows whether I'm making or losing money on the operating side. No more waiting months for a painful revelation!

Moving from siloed knowledge to an interconnected and holistic ecosystem

Unlike traditional training courses that segment everything into hyper-specialties (accounting for accountants, finance for financiers), this course adopts an approach holistic (like my big guide to the ideal diet, where I advocate a holistic view of health and longevity). Here, we will build bridges between the fields so that you become a versatile expert. Here are the main thematic sections, presented not as walls, but as an interconnected flow:

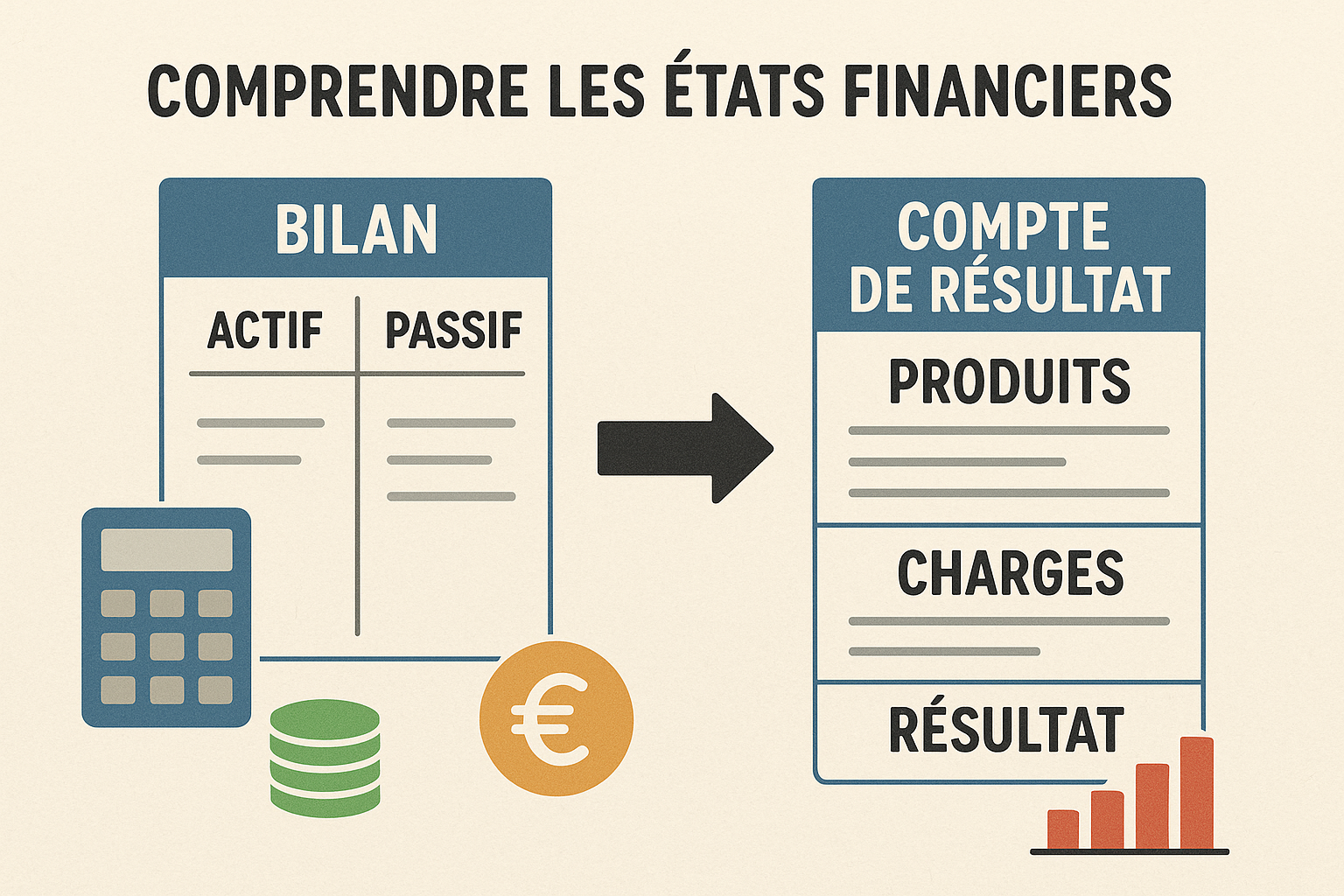

- Basic Accounting : It's not just a legal chore. It's the foundation for capturing the day-to-day reality of your business. For example, by categorizing invoices and expenses (expense accounts), you get a balance sheet and income statement that reveal financial health in real time. Practical benefit: Avoid discovering losses a year later; adjust month-to-month to stay profitable.

- Management Control : Directly connects to accounting. From your accounting data, calculate indicators such as cost price, break-even point, or margins. Bridge with accounting: Your classified invoices feed into these calculations to set fair prices or pivot if the business model isn't working. Benefit: Instead of blindly boosting turnover, make sure that every euro sold generates a profit—as I should have done at Libshop to avoid prices that are too low.

- Corporate Finance : Builds on the previous two to analyze debt, equity, or evaluate a company (for a takeover or to monitor the competition). Bridges: Use your balance sheet and management costs to assess whether an investment is viable, or whether a market is attractive. Interest: Become able to analyze a competitor without an external expert, or to negotiate a takeover with full knowledge of the facts.

- Strategic Management : The ultimate summary. Connects everything for day-to-day management, year-to-year management, or management during key decisions (expansion, pivot). Holistic bridges: A monthly dashboard (from accounting) informs your costs (control), which guide your finances for agile management. Benefits: Transform yourself into a "Swiss Army knife" manager who monitors everything—from daily profitability to market assessment.

These areas aren't isolated: accounting feeds into control, which informs finance, ensuring smooth management. Ignore these bridges, and you risk hyperspecialization—delegating everything to experts without understanding, thus losing control of your business.

Why Master It Yourself? The Pitfalls of Blind Delegation

In a world of hyperspecialization, we are told: “Focus on your core business, delegate the rest.” But for an entrepreneur, it's often fatal. Outsourcing accounting without paying attention? You lose visibility into your true profitability. Delegating finance? You miss opportunities like evaluating a takeover or monitoring a market.

The approach of this course: regain control of your business, and gradually become an expert in each field inherent to entrepreneurship for business leaders, and management for managers, even if it takes time.

For what ? To decide quickly and wellConcrete example: In my company, I ignored the daily classification of invoices for a long time, I only dealt with it after several months, late, considering it a time-consuming and unnecessary task, only necessary for legal reasons. What I didn't know was that assigning these invoices to expense accounts actually allowed me to establish a monthly dashboard, essential for not navigating blindly, and for making informed decisions month after month, year after year. This is something that very few entrepreneurs know, and yet it is essential information for running a business well.

Today, by mastering this, I instantly know if a month is profitable—and I can adjust marketing, pricing, and payroll. And most importantly, I can fine-tune my company's story and potentially tell it to stakeholders.

In short, this holistic mastery saves you time and money. It equips you to formalize a solid business model from the start, pivot if necessary, and scale with confidence.

Little exercise: think about your own management

To anchor these ideas, let's take 5 minutes for a simple exercise. No complex calculations required – just thinking!

- List 3 areas that you currently outsource (e.g.: accounting, management control, finance, marketing, community management, SEO, etc.).

- For each one, note why you are delegating (e.g.: “Too technical,” “No time,” or “Time-consuming” for example).

- Imagine a “what if”: What are you potentially missing out on by not controlling this yourself? (E.g., no monthly visibility on profitability → risky pricing decisions, leading to hidden losses.)

Personal example: For accounting, I delegated because "obligatory and boring". What I missed: A dashboard to track high loads in real time.

Of course, it's absolutely not about becoming an accountant, an advertising professional, or an SEO expert. But by training, you become an active participant in your company, not just a visionary leader or a purely operational craftsman, and you protect yourself against information asymmetries. You understand the language of the different stakeholders, and you no longer get fooled.

If you have any suggestions for topics you'd like me to cover, please share your answers in the comments below! This will help me tailor future chapters, and we can discuss common pitfalls.

Conclusion: Ready to become a seasoned pilot?

This "Chapter Zero" has shown you why corporate management and finance aren't just a requirement: they're a superpower for entrepreneurs, executives, and managers. By holistically connecting these areas, this course will train you step by step to become a seasoned decision-maker, capable of managing day-to-day operations or assessing a market.

Subscribe to the blog to never miss a thing, and feel free to leave a comment. See you soon for more!

👉 Next Chapter: The Basics of Accounting

📖 Table of Contents (you are here)