In this new course taken from the Complete Guide to Business Management, we will discover what it consists of leverage, with the aim of introducing us to the inner workings of general accounting and business management.

This content is part of the course “Business Management for Entrepreneurs: A Complete Course to Better Manage Your Business” find it on Tulipemedia.com 💰📈

General definition of leverage

Leverage refers to the use of debt For increase investment capacity of a company, with the aim of improving the return on equity, i.e. the profitability of shareholders.

It therefore measures the return on equity in the case where one goes into debt, and expresses the impact recourse to debt (third-party capital) versus equity financing alone.

This is a double-edged sword, because if the cost of borrowing becomes greater than the increase in profits expected from that borrowing, the leverage becomes negative.

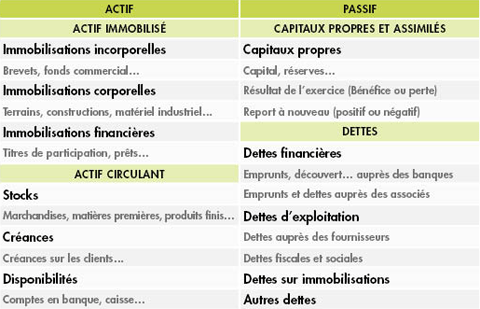

In order to fully understand the concept of leverage, and as it is a concept that measures the profitability of equity in the case of debt, it is important to recall the concepts of equity and financial debt, which are two items located in the liabilities side of the balance sheet:

Do you have a business and want to regain control of your margins and your business model? Discover my solution Ultimate Business Dashboard which transforms your raw accounting data into performance indicators and a monthly dashboard.

- equity, including share capital, is provided by the company's shareholders;

- debts, including financial debts, are incurred with financial institutions.

These two major categories, equity and debt, allow, as we have said in previous chapters, to finance the fixed assets and current assets of the company, in other words its means of production (factory, business assets, machinery, etc.) and its purchases of goods, raw materials or even its customer receivables.

Here we will refer to these assets (fixed and current) as being the economic assets of the company, which of course belongs to the company.

And regarding debts, and more specifically financial debts (long-term in particular), this is a debt incurred by the company and contracted with financial institutions, which in exchange, demand repayment of the amount borrowed with interest. This interest depends on the interest rate set upfront when the credit was contracted, and which therefore corresponds to the remuneration of the financial institution.

Finally, as we discussed in previous chapters, the interest of the company and its shareholders is to generate profits, the amount of which is shown in the income statement. And this profit will be reflected in the company's equity, more precisely in the result.

Economic profitability

Now that we have understood this well, we will discover what the economic profitability of a company, because this concept will then allow us to understand how to calculate the leverage effect.

Economic profitability actually measures the company's performance in using its economic assets (everything that allows it to produce and continue its activity: fixed assets + working capital requirements). Working capital requirements, as a reminder, measure what the company needs to finance its current assets (stock and customer receivables), after deducting current liabilities (short-term debts granted by banks or suppliers, for example).

There are two formulas corresponding to the economic profitability ratio:

French version of ROCE

ROCE = EBITDA or REX / Equity + Long-term Debt

This ratio measures the economic profitability before taxes, and taking into account or not depreciation and provisions. With EBITDA, depreciation and provisions are not taken into account, while with EBIT they are taken into account (that is to say they are deducted from the calculation method in order to reflect the depreciation of certain assets and the money "set aside" for possible risks and charges to be expected).

International version of ROCE: ROIC (return on invested capital)

Economic profitability = Operating profit after tax (NOPAT) / Capital invested

In this formula:

- invested capital refers to the equity capital provided by shareholders And net financial debt. In other words, this brings together long-term resources.

Invested capital = Equity + Net financial debt

- Net operating profit after tax (NAPOT) refers to operating profit less the theoretical tax on that profit.

Operating profit after tax = Operating profit – (Operating profit x Tax)

The importance of economic profitability

ROCE and ROIC refer to the same idea: how much the company earns per euro of capital invested in its activity.

The French version often uses EBE before tax, while the Anglo-Saxon version prefers NOPAT after tax.

This economic profitability reflects the economic efficiency of the company, regardless of the financing structure (debt vs equity).

The "Return on Assets" (ROA), often used in Anglo-Saxon literature, is a similar measure but calculated differently (net income divided by total assets).

In summary, economic profitability generally measures the ratio between the operating profit obtained and the resources mobilized to obtain that operating profit, without seeking to distinguish between the different sources of resources mobilized.

Return on equity (financial profitability or ROE)

Another important concept to consider, closely related to the previous one, is financial profitability (ROE for Return On Equity), which simply measures the company's profitability for shareholders. It measures net income relative to shareholder investment (the famous equity), and no longer relative to all capital invested (equity + debt).

This profitability is calculated as follows:

ROE = net profit / equity.

This ratio is central because, ultimately, Leverage relates to financial profitability : It is this that is amplified (or reduced) by resorting to debt., depending on the difference between economic profitability and the cost of debt.

Leverage as a measure of return on equity

It is essential to understand that leverage has no influence on economic profitability. Indeed, economic profitability depends solely on the operating profit generated by economic assets, compared to total invested capital (equity + debt). In other words, with equal funding, whether the project is financed solely by shareholders, solely by borrowing, or by a mixture of the two, the productive asset remains identical and it generates the same result. The economic profitability is therefore unchanged, once it has been fixed, whatever the method of financing, and with equal financing.

On the other hand, what varies greatly with the use of debt is the return on equity (ROE). By reducing the share of equity in financing and introducing a cost of debt, we change the way in which net income is distributed between shareholders and creditors: part of the financing of the asset is borne by the creditors, and the shareholders' profitability (the net income in relation to their initial investment) then aims to be higher.

It is precisely this difference that constitutes the leverage effect: it is not a question of increasing economic profitability in absolute value, but rather of amplifying (or reducing) profitability for shareholders.

In other words, debt acts as a multiplier of financial profitability: if economic profitability is higher than the cost of debt, leverage is positive and shareholder profitability increases. Conversely, if the cost of debt exceeds economic profitability, leverage becomes negative and shareholder profitability decreases.

In these explanations, we started from the assumption that the company had to make a trade-off between two financing methods for the same investment. However, in practice, companies sometimes have the choice between a contribution of equity only (for example 100) and a contribution of both equity and debt (100 + 100 for example). The leverage effect can therefore also measure the impact of this debt, however, it is important to understand that the economic profitability between the two scenarios will not be the same, unlike the example taken previously, because the investment will not be the same!

Example

For example, if a company has an after-tax operating profit of 100, and it has incurred 200 to obtain it, then its profitability is 100 / 200 = 50%.

In other words, when the company invests 200 (regardless of the financing method), this generates a result of 100, a result that it will potentially be able to repeat without having to reinvest the same initial amount, since it is a long-term investment intended to last by nature.

And this is where leverage comes into play, because if the company wants to capitalize on this investment by doubling the stake for example, but it cannot or does not want to do it with its own money, then it can borrow, in order to increase its investment (400 instead of 200 for example), and thus improve the return on equity thanks to what is called leverage, which consists of using debt to invest more, with the ultimate objective of improving profitability for shareholders.

But be careful, this only works if the cost of borrowing does not exceed the expected profitability; otherwise we have a negative leverage effect.

Leverage Formula

Everything we have seen previously therefore brings us to the formula for leverage, which, as we recall, measures the return on equity (ROE) in relation to debt:

ROE = Economic profitability + (Economic profitability – Cost of debt) × Financial debt / Equity

This is the official formula, and we will have the opportunity later in this course to understand how we arrive at this formula from the financial profitability formula (Net Income / Equity).

In the meantime, let's break down this formula together so we understand it fully:

- First, we take the economic profitability (for example 10%), which, as we recall, is the ratio between the operating profit after tax and the capital invested to obtain this result. It is the return on economic assets, independent of any financing.

- The cost of debt is deducted from this economic profitability, which allows for a positive result if the profitability is higher than the cost of debt, or a negative result if the profitability is lower than the cost of debt. This therefore makes it possible to measure the excess performance compared to the cost of external financing.

- This result is multiplied by the ratio between financial debt and equity: this ratio allows us to measure the "weight" of debts on the funds provided by shareholders. The more debt the company uses in relation to its equity, the more this amplifies the leverage effect.

- And we add all this to the basic economic profitability, because in fact, the economic profitability already represents the basic performance of the economic asset for the shareholders if the company does not go into debt, so this addition allows us to add the gain (or loss!) caused by the leverage effect

- The result of this formula therefore gives us the final return on equity (ROE).

It all comes down to the difference between economic profitability and the “cost of debt”, therefore the difference between the return on the economic asset and the interest rate.

Positive leverage

If the economic profitability exceeds the interest rate, then we can consider get into more debt, because the return on equity will be all the greater: in fact, as the difference between economic profitability and cost of debt is positive, and that this positive value is multiplied by the Financial Debt / Equity ratio which is higher in the case of debt than in the case of financing only by equity, this increases the value of the return on equity, if we analyze the formula carefully.

Negative leverage

Conversely, if the economic profitability is lower than the interest rate, the formula leads us to have a negative value at the level of the difference between the two, and if we get into more debt, the ratio Financial debt / Equity (which will be all the greater the more one gets into debt) go multiply this negative value, and this negative value, all the higher, will reduce the initial economic profitability, always according to the formula. So in this specific case, the leverage will be negative and will multiply the losses.

Unnecessary leverage

Furthermore, even if the leverage effect were positive in the case of debt, it must be kept in mind that all this is very theoretical, because in reality, This leverage will be positive provided that the economic profitability remains the same as more is invested, or, in practice, it may happen that a economic asset does not require additional investment, and that debt is simply unnecessary.

For example, the market may not absorb twice as much production (e.g., investing to open a second restaurant identical to the first in the same catchment area, which would probably not double the customer base), or economies of scale may reach a ceiling (e.g., producing more requires hiring more staff and buying more machines, which prevents further reduction of the cost per unit. In this case, the percentage economic profitability may stagnate or decrease. However, the absolute result may remain higher, which may justify the additional investment, even if the leverage becomes less important or more risky).

In any case, all this reminds us that increased investment does not necessarily lead to the same economic profitability, and in the case where debt is likely to lead to a decrease in this economic profitability, there may not be any additional profitable projects to finance, and debt may be useless because it does not create value. In other words, debt only makes sense if there are new profitable projects to finance. Otherwise, it only weighs down the financial structure without improving performance.

Leverage and distribution between equity and debt

The problem we have just mentioned shows us that the “pure” leverage effect is ultimately measured for the same investment, by simply comparing the distribution between equity and debt.

In the case where the company is considering a larger project that can only be financed primarily by additional debt (which is often the case in practice), a kind of leverage effect can be calculated, but this measure becomes less strict, since the economic profitability of the project can vary with the size of the investment.

In other words:

- The “classic” leverage effect is made on an identical investment, just with a different distribution between equity and debt. We therefore assume that we must arbitrate between a contribution of equity by shareholders, or debt.

- However, it can be estimated for a larger project only through debt, but it should always be noted that economic profitability can vary with the size of the project, therefore leverage is not strictly comparable to the base scenario.

Examples of leverage

Example of positive leverage

To better understand these concepts, let's take a very simplified example. Let's imagine that a company has an economic profitability of 15%. In other words, for €100 invested in its economic assets (factory, machine, etc.), the operating profit after tax is €15. Let's therefore assume that the company has already invested €100 through its own funds, i.e. through the capital contributions of its shareholders. It has therefore generated €15 in profit.

Now suppose the company borrows an additional €100 at a rate of €10%. This new investment also earns it €15 (€100 %). But since it has to pay €10 in interest to the bank, the net gain from the debt is €5.

Thus, thanks to the leverage effect, shareholders benefit from additional profitability financed by debt, because the return on assets (15 %) is higher than the cost of debt (10 %).

Here, the profits obtained through debt are greater than the cost of debt (€15 VS €10, i.e. a capital gain of €5), so the leverage effect is fortunately positive.

If we compare the two scenarios, with and without debt, here is what it gives:

Debt-free:

- Equity = €100

- Economic assets = €100

- Net result = €15

- Economic profitability = 15%

- Return on Equity (ROE) = 15 %

For information, ROE measures net profit in relation to equity, and therefore ultimately, profitability for shareholders.

Economic profitability measures the economic "performance" of the company as a whole (and not just the profitability of shareholders), and it is obtained as we saw before by dividing the operating profit after tax (therefore Profits - Taxes) by the investment (therefore equity + financial debts, i.e. everything that finances the production tool).

With €100 of debt:

- Equity = €100

- Debt = €100

- Interest rate = 10% or €10

- Total economic assets = €200

- Economic profitability = 15%

- Operating profit after tax = 15% * 200€ = 30€

- Interest = –10 €

- Net result = €20

- So ROE = 20 %

This example shows that debt can increase the return on equity, but it also increases risk: if the economic return were to fall below the cost of debt, leverage would become negative, which brings us to the next example.

Example of negative leverage

Let's imagine the same company, but this time with a lower economic profitability, say 5 %.

Debt-free:

- Equity = €100

- Operating profit after tax = €5

- Return on Equity (ROE) = 5 %

With debt:

The company decides to borrow €100 at a rate of 10 %.

- Equity = €100

- Debt = €100

- Interest rate = 10% or €10

- Total economic assets = €200

- Economic profitability = 5% instead of 15% in the previous example.

- Operating profit after tax = 5% * 200€ = 10€

- Interest = –10 €

- Net result = €0

- So ROE = 0 %

Conclusion

In this case, since the economic profitability (5 %) is lower than the cost of debt (10 %), the leverage effect is negative. The debt has destroyed the profitability for shareholders, while they would have earned 5 % without debt, they end up at 0 %.

Demonstration of the leverage formula

In order to fully grasp the logic and understand the leverage formula, it is important to deconstruct the formula in order to understand its ins and outs.

As a reminder, the complete formula for the Leverage Effect is as follows:

ROE = Economic profitability + (Economic profitability – Cost of debt) × Financial debt / Equity

This formula allows you to compare two identical investment scenarios, but with a different distribution between debt and equity.

To demonstrate this formula, we start again from the simple formula that we already stated at the beginning of this course, which is the following:

ROE = net profit / equity.

We always start with this simplest formula. It defines return on equity (ROE) as the ratio of net income to equity (ROE = Net income / Equity). This is the basic, universal definition that works in all cases.

But to better understand the role of debt, it is interesting to develop this formula by introducing the economic profitability (ER) of the financed asset and the cost of debt. This development makes it possible to obtain the so-called "leverage effect" formula, which highlights how the difference between economic profitability and cost of debt amplifies (or reduces) the return on equity depending on the relative weight of debt (Debts/Equity).

The interest of this developed formula is not to replace the simple formula, but to make visible the precise effect of the financing structure : it thus allows compare two scenarios with an identical total investment but a different distribution between equity and debt, and to see under what conditions debt actually improves profitability for shareholders.

But how do we arrive at this formula? That's what we'll see right away.

To do this, we start from the simple formula of return on equity, also called financial profitability, and ROE (Return on Equity):

ROE = net profit / equity.

Now, we know that net profit is nothing other than operating profit less taxes and interest charges, which therefore amounts to writing:

ROE = (operating profit – ix D) / Equity

Where i is the interest rate, and D is the amount of debt.

Now, to arrive at the final formula for leverage, we need to further develop the above formula by detailing the calculation of operating income. To do this, we start with another formula, that of economic profitability (ER), which we remember is equivalent to:

RE = Operating profit after tax / (Equity + Equity + D)

Now let's isolate the operating profit after tax:

Operating profit after tax = RE x (Equity + D)

So, we can inject this detail into the formula for return on equity:

ROE = RE x (Equity + D) – ix D / Equity

We develop:

ROE = RE x Equity + RE x D – ix D / Equity

We factor the debt D:

ROE = RE x Equity + D x (RE – i) / Equity

Then, we separate the fraction into several partial fractions having the same denominator as Equity:

ROE = (RE x Equity / Equity) + (D x (RE – i) / Equity)

And finally, we simplify the first term (because Equity / Equity = 1), and we obtain the developed formula for the leverage effect:

ROE = RE + (RE – i) x D / Equity

Which amounts, in good French, to:

ROE = Economic profitability + (Economic profitability – Cost of debt) × Financial debt / Equity

And this formula therefore allows us, as in the examples given in this article, to compare several scenarios of distribution between debt and equity for the same investment.

Conclusion on leverage

Leverage is a powerful mechanism for understanding how debt financing works can transform the return on equity. It does not change the economic profitability of the asset itself, but acts as a shareholder profitability amplifier : upwards when economic profitability exceeds the cost of debt, and downwards otherwise.

In practice, this means that Debt can be a great opportunity for growth, but also a real risk if the company goes into debt for unprofitable or uncertain projects.

Leverage is therefore neither good nor bad in itself: it is a tool, the effectiveness of which depends on the economic context, the solidity of the projects financed and the company's ability to manage its debt.

In summary, remember three essential ideas:

- Economic profitability remains the starting point: without profitable projects, debt is useless.

- Leverage only affects financial profitability (ROE), which is also referred to here as return on equity, i.e. what shareholders earn.

- Like any lever, it can amplify a positive movement… or worsen a negative situation.

This course is now over, and I'll see you soon for new training courses on management and entrepreneurship!

👉 Next chapter: Debt ratio and financial autonomy.

📖 Back to Table of Contents