Welcome to this new course of the Complete Guide to Business ManagementHere, we will look at what a balance sheet is, always with the aim of introducing us to the workings of general accounting and business management.

This content is part of the course “Business Management for Entrepreneurs: A Complete Course to Better Manage Your Business” find it on Tulipemedia.com 💰📈

Definition of the balance sheet

The balance sheet is a document that describes the financial health of the company at a given time, generally at the closing of the annual accounts. It allows you to identify what the company owns (the assets) And what she owes (the liabilities), in other words the resources committed to financing its assets (share capital, loans, etc.). The balance sheet is one of the most common tables.

It is used in particular to know the value of the company and ensure its solvency, and it is therefore essential for a manager or business leader to understand how to read and interpret it.

You should know that the asset is always equal to the liability, whether there is a profit or a loss. In fact, accounting is kept "double-entry", that is to say that to record any financial flow, two identical amounts must be entered: one to explain where the money comes from and a second to explain what is done with this money.

This subtlety is often misunderstood by beginners, who mistakenly think that the balance sheet is used to report a profit or loss, when in fact this primarily concerns the income statement. The result is nevertheless reported on the balance sheet (at the Liabilities level), but it is not the central subject of the balance sheet.

Do you have a business and want to regain control of your margins and your business model? Discover my solution Ultimate Business Dashboard which transforms your raw accounting data into performance indicators and a monthly dashboard.

Structure of the balance sheet

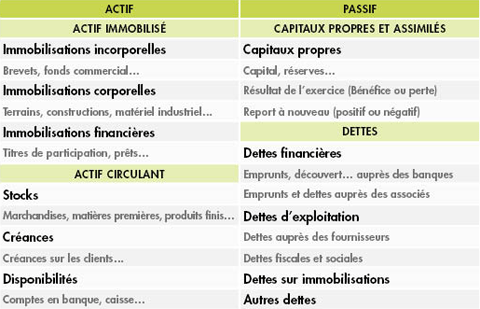

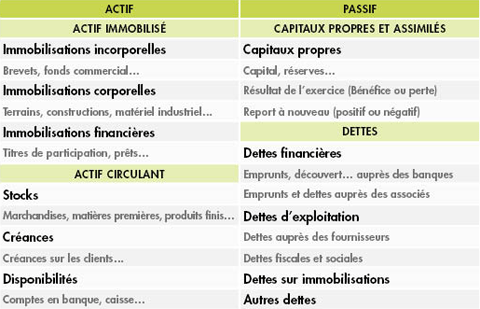

A balance sheet is a heritage photography of the company which divides into 2, with on the left, the balance sheet assets (what the company owns), and on the right, the balance sheet liabilities (what the company owes and what it uses to finance the assets).

Assets and liabilities are then each divided into 2 categories:

- Fixed assets, which are all fixed assets necessary for the company's activity (machines, production tools, securities, etc.).

- Current assets, which constitute all the assets held by the company and intended not to remain there permanently (stocks, receivables, cash, balance on bank accounts, etc.).

- Long-term debts, which include share capital and reserves (which are debts to the partners).

- Short-term debts, which consist of obligations towards third parties generating an outflow of money (supplier debts, bank loans, tax and social security debts, etc.), generally less than one year.

The balance sheet assets

The assets side of the balance sheet lists the items in the company's possession (all of its assets and receivables). It is ranked in order of liquidity : at the top, what the company keeps for a long time (not very liquid), at the bottom what it can quickly convert into cash (very liquid).

Here are the main elements making up the assets of the balance sheet:

- Intangible assets (software, website, patents, licenses, etc.)

- Tangible fixed assets (land, buildings, machinery, large tools, etc.)

- Financial assets (financial securities, guarantees, etc.)

- Stocks of goods and raw materials

- Customer, tax and social security receivables still due at the balance sheet date

- Cash, including bank accounts, investment securities, other cash investments, etc.

The liabilities of the balance sheet

Liabilities are the list of what the company uses to finance and develop its business (partners, banks, suppliers). Here are the main items making up the liabilities on the balance sheet:

- The company's equity (share capital, operator's account, reserves, retained earnings, financial result for the past year and possibly issue premiums).

- Provisions for risks or charges;

- Financial debts (the amount of bank loans outstanding and associated current accounts).

- Supplier, tax and social security debts still owed to the company on the balance sheet date.

On the liabilities side, the result for the financial year (taken from the income statement) corresponds to the result for the previous year. If there is a profit, it will be distributed in the form of dividends among shareholders or placed in "reserves" or left in positive "retained earnings."

If the result is negative, it is fully allocated negatively the following year to the "retained earnings" section. There can be no distribution of dividends or allocation of reserves until the company's negative retained earnings have been fully offset by subsequent profits.

But we will come back to these topics later.

The different asset categories of a balance sheet

The balance sheet asset is made up of several categories, which we briefly listed above. Here are explanations of each of them, so you can better understand what they are.

Fixed assets 🏗️

Fixed assets correspond to everything that the company uses sustainably (for more than a year) for its activity. We can say that these are the company's "working tools." They are divided into three subcategories:

a) Intangible assets

These are the intangible assets used by the company in a sustainable manner:

-

Patents, licenses

-

Software

-

Business funds

-

Brands

b) Tangible fixed assets

These are the physical goods used sustainably:

-

Land, buildings

-

Equipment, machines

-

Vehicles

-

Office furniture

c) Financial fixed assets

These are the amounts invested or loaned long term :

-

Security deposits

-

Loans granted

-

Investments in other companies

👉 These assets are not intended for immediate resale. They help generate value over time.

Current assets 💼

Current assets are everything that the company consumes, sells or transforms in the short term, generally within the year.

a) Stocks and work in progress

- Raw materials

- Products in production

- Finished products or goods ready for sale

(b) Trade receivables and other receivables

Receivables correspond to the sums that customers or other organizations owe to the company in the short term:

- Accounts receivable: The company has sold, but has not yet been paid.

- VAT to be recovered

- Expected aid or subsidies

- Advances paid to suppliers

c) Availability

This is the treasury:

- Bank accounts

- Box

- Checks to be cashed

👉 The deeper you go into assets, the more easily items are converted into cash. They are said to be increasingly "liquid."

🧮 Simplified example of the balance sheet asset

Here is a small illustrated example to help you understand better:

| Category | Example in a bakery |

|---|---|

| Tangible fixed assets | Oven, display cases, cash register, delivery truck |

| Intangible assets | Logo, special bread recipe (protected recipe) |

| Stocks | Flour, chocolate, unsold bread |

| Accounts receivable | Invoices sent to a partner restaurant |

| Availability | Cash in hand, bank account |

The different categories of liabilities on a balance sheet

I am providing here the illustration representing the different categories of a balance sheet as a reminder:

After seeing what the company has in assets, it is time to look at what it owes. The liabilities of a balance sheet represent precisely the origin of the resources that allowed the company to finance what it owns.

In order to become a true manager capable of reading a balance sheet and interpreting it, it is important to understand this because it is the basis of the accounting balance sheet: the asset is financed by the liability, and you have to memorize this in order to do a kind of intellectual gymnastics.

More precisely, current assets are financed by current liabilities (short-term liabilities), and fixed assets are generally and logically financed by long-term liabilities (the company's equity).

Coming back to liabilities, we say that it groups together what the company owes (to those who finance the company and therefore the assets on the balance sheet). And what the company owes is broken down into two categories:

- Equity and similar: what it owes to its partners (invested capital, profits to be distributed).

- Debts: what it owes to its creditors (banks, suppliers, State, etc.).

Like assets, liabilities are classified in order of due date:

👉 at the top, what is due in the long term

👉 below, what is due in the short term

Let us now look at the passive categories as planned.

Equity 💼

Equity represents the resources contributed to the company by itself or by its partners. These include the following positions.

a) Share capital

These are the contributions made by partners or shareholders when creating the company or during capital increases.

b) Reserves

This is a portion of past profits that the company has kept to strengthen itself instead of distributing them.

c) Net result for the financial year

This is the profit (or loss) generated in the current year.

d) Other elements

Possibly: issue premiums, investment subsidies, etc.

👉 These funds belong to the owners of the company, and contribute to its financial strength. It is sometimes said that it is “patient” money, therefore long-term liabilities.

Debts (liabilities owed to third parties, short or long term) 💳

The debts are what the company actually owes to third parties, and which it will have to repay, in the short or long term. They are divided into several categories:

a) Financial debts

Bank loans, leases... These are debts taken out to finance the activity, generally long-term, although there may be payment facilities which are considered short-term financial debts.

b) Supplier debts

What the company owes to its suppliers of goods or services (invoices received but not yet paid). This is generally a short-term debt.

c) Tax and social security debts

VAT to be paid, taxes to be paid, salaries to be paid, URSSAF contributions, etc.

d) Other debts

For example, advances received from customers, rents due, or dividends to be paid.

👉 These debts are generally payable in the short term, except for long-term loans.

🧮 Simplified example of the liabilities of a balance sheet

Let's take the example of a hair salon:

| Category | Concrete example |

|---|---|

| Share capital | Money invested by the manager |

| Reserves | Retained earnings from previous years |

| Net result | Result (profit or loss) for the current year |

| Financial debts | Bank loan to renovate the premises |

| Supplier debts | Shampoo bill to pay |

| Tax and social security debts | VAT collected, January salaries, URSSAF to be paid |

| Other debts | Customer deposit for a future service |

-

Is she autonomous (a lot of equity)?

-

Or heavily indebted (heavy dependence on loans and debts)?

👉 This allows you to evaluate its financial strength and his risk of failure.

📝 In summary

-

Liabilities = the origin of the company's resources

-

Equity = what the company “owns” itself

-

Debts = what she must repay in the short or long term

-

The higher the debts, the more the company depends on its creditors

🎯 Balance sheet exercises (with answers)

Here are some simple exercises to test your knowledge of the balance sheet, assets, liabilities, and their different categories. The answers are available below each exercise.

🔍 Exercise 1 – Classify the following items as assets or liabilities

Indicate whether each item belongs to the assets or liabilities of the balance sheet, and specify the subcategory if possible.

| Element | Active or Passive? | Category / Subcategory |

|---|---|---|

| A computer | ||

| A 5-year bank loan | ||

| An unpaid customer invoice | ||

| A stock of raw materials | ||

| Share capital | ||

| VAT to be paid | ||

| A registered trademark | ||

| A customer deposit received |

✅ Fixed:

| Element | Active or Passive? | Category / Subcategory |

|---|---|---|

| A computer | Active | Bodily immobilization |

| A 5-year bank loan | Passive | Financial debt |

| An unpaid customer invoice | Active | Accounts receivable (current assets) |

| A stock of raw materials | Active | Stock (current assets) |

| Share capital | Passive | Equity |

| VAT to be paid | Passive | Tax debt |

| A registered trademark | Active | Intangible asset |

| A customer deposit received | Passive | Other debt |

🧮 Exercise 2 – Quick reading of a mini-assessment

Here is a simplified mini-assessment.

It's up to you to answer the questions just below.

Active :

-

Fixed assets: €60,000

-

Stocks: €10,000

-

Trade receivables: €15,000

-

Availability: €5,000

Passive :

-

Equity: €40,000

-

Bank loan: €30,000

-

Supplier debts: €15,000

-

Tax and social security debts: €5,000

Questions :

| Question | Your answer |

|---|---|

| What is the total assets? | |

| Is the balance sheet balanced? | |

| Is the company financed by equity or debt? | |

| What is the share of short-term debt? |

✅ Fixed:

-

Total assets = 60,000 + 10,000 + 15,000 + 5,000 = 90 000 €

-

Total liabilities = 40,000 + 30,000 + 15,000 + 5,000 = 90 000 € → ✅ The balance sheet is balanced

-

Equity = €40,000 / Total debts = €50,000 → The company is mainly financed by debt

-

Short-term debts = Supplier debts + tax and social security debts = 20 000 €

🧠 Exercise 3 – Reflection

Explain in your own words:

👉 Why do we say that assets are equal to liabilities?

👉 Why do we put equity in liabilities when it is "the company"?

💡 Response elements:

👉 Why do we say that assets are equal to liabilities?

Assets represent what the company owns (its uses), while liabilities represent how it financed those possessions (its resources). Each resource was used to finance a use: this is why, by construction, assets are always equal to liabilities.

👉 Why do we put equity in liabilities when it is "the company"?

Equity is considered a company's debt to its shareholders. It is the contributions and retained earnings that the company owes, in a sense, to its owners. From an accounting perspective, it is therefore recorded as a liability, just like other resources.

🧪 Exercise – Bring a balance sheet to life in 5 operations

Fill in the table below after each operation. For each item, first write the account name (eg: Bank), then its amount.

- Capital contribution of €10,000 to the bank account

- Purchase of a machine for €5,000, paid in cash

- Purchase of a business for €8,000 financed by a long-term bank loan

- Purchase of €3,000 of goods on credit (supplier debt)

- Sale of half of the stock (€1,500) for €2,500 collected

💼 Exercise 4 – Assessment after each operation

| Stage | Active | Amount (€) | Passive | Amount (€) |

|---|---|---|---|---|

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 |

🟢 Corrected

| Stage | Active | Total | Passive | Total |

|---|---|---|---|---|

| 1 | Bank: 10,000 | 10 000 | Share capital: 10,000 | 10 000 |

| 2 | Bank: 5,000 Machine: 5,000 |

10 000 | Share capital: 10,000 | 10 000 |

| 3 | Bank: 5,000 Machine: 5,000 Business assets: 8,000 |

18 000 | Share capital: 10,000 Bank loan: 8,000 |

18 000 |

| 4 | Bank: 5,000 Machine: 5,000 Business assets: 8,000 Stock: 3,000 |

21 000 | Share capital: 10,000 Bank loan: 8,000 Supplier debts: 3,000 |

21 000 |

| 5 | Bank: 7,500 Machine: 5,000 Business assets: 8,000 Stock: 1,500 |

22 000 | Share capital: 10,000 Bank loan: 8,000 Supplier debts: 3,000 Profit result: 1,000 |

22 000 |

📘 Conclusion

You now have a good understanding of the basic structure of a balance sheet.

👉 I invite you to reread and reread the course in order to fully understand the basics of what a balance sheet is, after which you can move on to the rest of the guide on business management!

👉 Next chapter: Understanding Working Capital (WC) and Working Capital Requirement (WCR)

📖 Back to Table of Contents